Dina sent me this article from the UK Daily Mail.

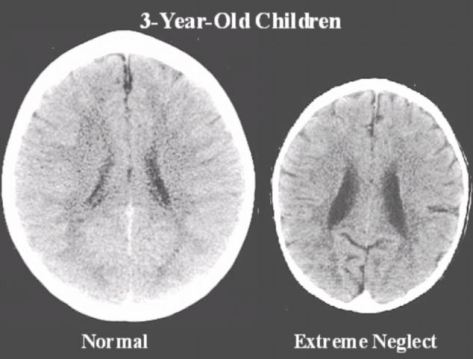

Here is the scan:

Excerpt:

Both of these images are brain scans of a two three-year-old children, but the brain on the left is considerably larger, has fewer spots and less dark areas, compared to the one on the right.

According to neurologists this sizeable difference has one primary cause – the way each child was treated by their mothers.

The child with the larger and more fully developed brain was looked after by its mother – she was constantly responsive to her baby, reported The Sunday Telegraph.

But the child with the shrunken brain was the victim of severe neglect and abuse.

According to research reported by the newspaper, the brain on the right worryingly lacks some of the most fundamental areas present in the image on the left.

The consequences of these deficits are pronounced – the child on the left with the larger brain will be more intelligent and more likely to develop the social ability to empathise with others.

But in contrast, the child with the shrunken brain will be more likely to become addicted to drugs and involved in violent crimes, much more likely to be unemployed and to be dependent on state benefits.

The child is also more likely to develop mental and other serious health problems.

Professor Allan Schore, of UCLA, told The Sunday Telegraph that if a baby is not treated properly in the first two years of life, it can have a fundamental impact on development.

He pointed out that the genes for several aspects of brain function, including intelligence, cannot function.

[…]The study correlates with research released earlier this year that found that children who are given love and affection from their mothers early in life are smarter with a better ability to learn.

The study by child psychiatrists and neuroscientists at Washington University School of Medicine in St. Louis, found school-aged children whose mothers nurtured them early in life have brains with a larger hippocampus, a key structure important to learning, memory and response to stress.

The research was the first to show that changes in this critical region of children’s brain anatomy are linked to a mother’s nurturing, Neurosciencenews.com reports.

The research is published online in the Proceedings of the National Academy of Sciences Early Edition.

Lead author Joan L. Luby, MD, professor of child psychiatry, said the study reinforces how important nurturing parents are to a child’s development.

I have a very good feminist non-Christian friend who sometimes comments here. I once asked her about marriage and she said that her skills would be wasting on raising children. I explained to her my view that a mother needs to stay at home with the children, and that is more important work. I expect my future wife to read all kinds of books on child care and to give the child attention, nutrition, exercise and play so that the child will grow up to be an effective Christian. Maybe I need to be clear. I am not going to spend hundreds of thousands per child with just any woman. I need a woman who can produce influential and effective Christians who will engage in the public square. And we do not entrust that job to just anyone – we want a Michele Bachmann or a Jennifer Roback Morse. Professional women who are willing to be stay-at-home moms when it’s necessary to do that.

I expect the woman I marry (if I marry) to have a college degree, and preferably a graduate degree, and a couple of years of employment. Then she has to stay home and invest in those children through the first five years at least. After that she can stay home or work as much as she thinks is beneficial to the family goals of impacting the university, the church and the public square – as well as continuing to raise those children. It’s not a waste of her talent to make the next William Lane Craig, the next Marsha Blackburn, the next Doug Axe, or the next Edith Jones.