Tag Archives: Pension

Democrat lawmakers flee state to avoid voting on spending cuts

Story from the Wall Street Journal.

Excerpt:

Democratic lawmakers fled the state in an effort to torpedo a closely watched vote on what would be the nation’s first major overhaul of union laws in years, as government workers flooded the statehouse for a third day seeking to block passage of the bill.

Surrounded by thousands of tightly packed protesters, including teachers who had been encouraged by union leaders to show up in force, state senators gathered around 11 a.m. to vote on Republican Gov. Scott Walker’s proposal to limit collective-bargaining rights for most state employees.

The governor’s proposal, part of a bill aimed at overcoming a $137 million deficit in the current budget and a projected $3.6 billion hole in the next two years, would allow collective bargaining on wages, but not pensions and health care. Workers would be required to pay more for both.

But a roll call revealed that the 14 Senate Democrats were absent, leaving the chamber short of the 20 votes needed to conduct business.

[…]Late Thursday, Gov. Walker, who could hear chanting every time he opened his office door, blasted the Democrats’ move as a “stunt” and urged them to return to vote on what he called as a “bold political move but a modest, modest proposal” that would preserve benefits for public employees that remained “better than what most people are getting across the state.”

The extraordinary scene was being followed in statehouses across the country, as a test case of both union clout and the political will of newly elected legislators. Wisconsin was at the front edge of voter discontent in 2010, with voters agitated about public spending electing Gov. Walker to succeed Democrat Jim Doyle and handing both houses of the legislature to the GOP.

[…]If the governor’s efforts succeed, other states are expected to try to follow, as governors grapple with deepening deficits. Many new governors in both parties have blamed the states’ fiscal crisis in part on what they say are overly generous benefits and pension obligations granted over many years to organized government workers.

Proposals similar to Gov. Walker’s have been made in New Jersey and Ohio. In Columbus, Ohio, thousands gathered Thursday to protest a Republican proposal that would eliminate collective-bargaining rights for many of that state’s 400,000 public-sector workers.

[…]Gov. Walker first introduced his “budget repair” bill just a week ago, setting off the firestorm that has swept the Capitol. Besides limiting collective-bargaining right for most workers—excepting police, firefighters and others involved in public safety—it would require government workers, who currently contribute little or nothing to their pensions, to contribute 5.8% of their pay to pensions, and pay at least 12.6% of health-care premiums, up from an average of 6%.

In exchange, Gov. Walker has pledged no layoffs or furloughs for the state’s 170,000 public employees. He has said 5,500 state jobs and 5,000 local jobs would be saved under his plan, which would save $30 million in the current budget and $300 million in the two-year budget that begins July 1.

The lawmakers are required by law to report to their posts to vote on all legislation, which is why the police were dispatched to locate them.

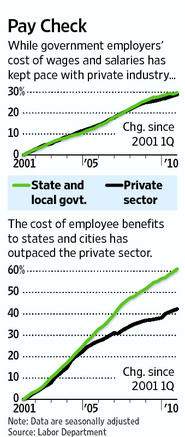

Here’s what the fuss is about:

And Gov. Walker is not the only one trying to stop the massive transfers of wealth from the productive private sector to non-productive public sector.

Excerpt:

Lawmakers around the country are looking at new ways to prevent budget disasters by changing the rules for overburdened state employee pension funds. But they are meeting stiff resistance from public employee unions.

Two Arizona state lawmakers this week, including the speaker of the House, introduced their plan to salvage the state’s budget by significantly changing the public retirement system.

Following the lead of Gov. Chris Christie, R-N.J., a pair of New Jersey assemblymen on Monday put forth their legislative solution to make solvent a fund that’s $54 billion in the red.

Also on Monday, in his first budget address as governor, Florida’s Rick Scott announced his effort to “stabilize and secure” government employee pensions.

The moves are part of a larger battle over pension reform between conservative budget hawks and government worker unions.

The national debt is currently over 14 trillion, and scheduled to be at 26 trillion by 2021.

Michelle Malkin has a breakdown of teacher salaries and benefits here.

Are public sector unions to blame for state and local deficits?

ECM sent me this post from the Manhattan Institute.

Full text:

The economists over at the e21 blog take on the argument being made by some pro-labor groups that public sector compensation (pay and the cost of benefits) is not a significant part of current state and municipal budget woes. In an editorial, e21 notes that state and local spending as a percentage of U.S. GDP has doubled in the last 50 years even as investment by local governments in traditional areas like building roads and bridges has been flat. Where has the money gone? Primarily to Medicaid and to public sector compensation.The editorial notes, for instance, that pension costs alone have increased in California from $2.4 billion per year to $4.8 billion from 2003 to 2009, while New York City’s pension obligations have tripled over the same period.

The Manhattan Institute’s Nicole Gelinas has illustrated how those costs have worked on New York City. Amidst the controversy over the poor snow-cleaning job done by the city’s sanitation department after the Dec. 26 snowstorm, Nicole pointed out that although the department has been shrinking, its personnel costs have been rising rapidly. The average cost of employing a single sanit worker in NYC is now $144,000 annually, up from $79,000 a decade ago. The big driver of costs is sharply rising pension contributions, up from $10 million a decade ago to $200 million today.

The editorial at e21 concludes by comparing public sector pensions with private pensions, using California’s formula for public workers as an example. For a state employee in California earning almost $83,000 at retirement after 25 years of service, e21 estimates that a similar private sector employee with a defined contribution plan would have to put away 23 percent of his pre-tax income every year to amass enough of a pot of money to purchase an annuity that would give him the same kind of retirement benefits.

“Put simply, it is difficult to conceive a way to address the current – and projected – state fiscal crisis without dramatic reductions in state and local employee benefits,’ the editorial concludes.

Somebody has to pay for all this mess.