Elizabeth Warren seems to be the likely Democrat nominee, so it it makes sense for us to take a look at her policy proposals and count the cost. Her signature proposal is a plan to outlaw private health insurance and move everyone to government-run health care, paid for though mandatory taxation. How much will that cost, and how much will the taxes on the middle class go up in order to pay for it?

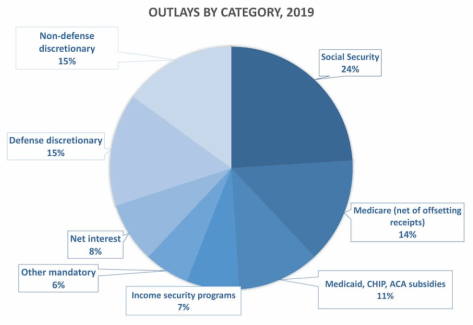

Before we go too far with that, take a look at the budget numbers. I got these from the web site of the Democrats in the House of Representatives:

According to the House Democrats budget web site, the 2019 federal budget has $3.451 trillion in revenue, $4.411 trillion in spending, for an annual deficit of $-960 billion. And keep in mind that we are $23 trillion in debt already. This would be like saying that your annual income is $34, 510. You’re spending $44, 110 per year. You are adding $9,600 to your debt every year. And you are already $230,000 in debt (and paying interest on that).

In other words, America is in no position to be spending more money. We’re already in debt, and adding to the debt each year. So how much more money would you have to spend for Elizabeth Warren’s health care plan?

For months, Sen. Elizabeth Warren (D—Mass.) has hedged on the question of whether she would raise middle class taxes to pay for Medicare for All, the single-payer health care plan she says she supports. Warren has stuck with a talking point about total costs, saying that the middle class would pay less, while critics, political rivals, and even liberal economists friendly to single payer have argued that the enormous additional government spending required by such a plan would inevitably hit the middle class.

Today, Warren released a plan to finance Medicare for All at a total price tag of nearly $52 trillion, including about $20 trillion of new government spending (an estimate that is probably low). Although her plan declares that no middle-class taxes will be necessary to finance the system, it includes what is effectively a new tax on employers that would undoubtedly hit middle-class Americans.

So , Warren admits that the total cost of her plan is $52 trillion over 10 years. Warren needs to come up with $5.2 trillion per year to pay for her plan. Is there that much money available by taxing only the wealthy?

The wealthiest Americans don’t have enough money to cover even $2 trillion in additional spending – assuming they continue to work in America as much as they did before the government took MOST of their earnings:

CRFB reinforced their prior work indicating that taxes on “the rich” could at best fund about one-third of the cost of single payer. Their proposals include $2 trillion in revenue from raising tax rates on the affluent, another $2 trillion from phasing out tax incentives for the wealthy, another $2 trillion from doubling corporate income taxes, $3 trillion from wealth taxes, and $1 trillion from taxes on financial transactions and institutions.

Several of the proposals CRFB analyzed would raise tax rates on the wealthiest households above 60 percent. At these rates, economists suggest that individuals would reduce their income and cut back on work, because they do not see the point in generating additional income if government will take 70 (or 80, or 90) cents on every additional dollar earned. While taxing “the rich” might sound publicly appealing, at a certain point it becomes a self-defeating proposition—and several proposals CRFB vetted would meet, or exceed, that point.

So, Warren is going to have to lean on the middle class for the remaining $3.2 trillion, even if the rich hold still while the government takes 70-90 percent of what they earn. (Unlikely)

Warren likes to tell everyone that her plan will make costs go down. I guess she thinks that government oversight of health care will be more efficient than private sector oversight of health care. Maybe she believes that people in government are more careful about spending taxpayer money than people in private businesses are about spending their own money? In any case, studies from centrist and center-left think tanks disagree with Warren:

Warren and her defenders will likely try to shift the discussion back to total costs, but that’s just a way of repeating the dodge that has dogged her campaign for much of the year. Warren will no doubt claim that costs would go down under her plan, but there are reasons to doubt this, including an analysis from health care economist Kenneth Thorpe finding that under a Sanders-style plan, more than 70 percent of people who currently have private insurance would see costs increase, as well as an Urban Institute analysis projecting that single-payer plans would raise national health care spending by $7 trillion over a decade.

All we have right now to weight against these studies is Warren’s own words, as a candidate wanting to win a popularity contest.

Warren herself says that there would be enormous job losses in the health care industry:

Democratic Massachusetts Sen. Elizabeth Warren admitted Wednesday that Medicare for All could result in two million lost jobs.

In an interview with New Hampshire Public Radio, the Democratic presidential contender said she concurs with a study from the University of Massachusetts-Amherst that said socialized medicine would probably have a devastating impact on the those working in the current private health care industry.

This would create similar health care shortages and waiting lists (with people dying on waiting lists) that we see in single-payer systems such as Canada and the Veteran’s Affairs health care system. Except far worse.

And keep in mind that the middle class pays for health care in Canada:

Socialized medicine in Canada anything but free. The [Fraser Institute] think-tank reported that the average Canadian family spends over $12,000 in taxes on government-funded health care.

That is how single-actually works. We need to look at how single-payer health care works in reality, and not form our opinions of it based on a candidate’s WORDS during an ELECTION CAMPAIGN. Let’s look at evidence, and not just vote for things that sound good and make us feel good and make our friends like us.