Americans for Tax Reform explains what’s in it.

Excerpt:

The main details are:

Revenue neutrality. The budget calls for the House Ways and Means Committee to produce a tax reform package with a tax revenue target of between 18 and 19 percent of GDP. This is in line with historical revenue figures. By contrast, big government budgets like “Gang of Six,” “Simpson-Bowles,” and the Obama budget call for a long-range revenue target of over 20 percent of GDP. The Ryan budget is a no tax hikes budget.

Six personal rates down to two. The Ryan budget replaces the current six-rate personal income tax structure (10, 15, 25, 28, 33, and 35 percent) with a two-rate system of 10 and 25 percent. This will result in a lower tax rate on the majority of small business profits, from 33 or 35 percent down to 25 percent.

Repeals Obamacare tax hikes. The Ryan budget eliminates the entire Obamacare law. This includes repealing the 20 new or higher taxes which have taken or are about to take effect from that law.

Eliminate the AMT. The Ryan budget eliminates the AMT, instead favoring a simpler system with lower rates and a broad tax base.

Lower rates on businesses. As said above, the Ryan budget lowers the tax rate on the majority of small business profits to 25 percent. It also lowers the federal income tax rate on larger corporate employers from 35 percent (the highest in the developed world) to 25 percent (closer to the developed nation average). While this makes American companies more competitive, it would still leave us with a higher corporate income tax rate than the developed nation average, Canada, and the United Kingdom. In order to make us truly internationally-competitive, the federal rate must fall to 20 percent or less.

No more picking winners and losers in the tax code. In order to target revenues at 18-19 percent of GDP with tax rates no higher than 25 percent, the Ways and Means Committee will have to curtail or eliminate most tax exclusions, adjustments, deductions, and credits. That means that all consumed income will be taxed once and only once. No longer will the tax code favor one type of economic behavior over another.

Moves tax code from “worldwide taxation” to “territoriality.” The Ways and Means Committee is directed to shift our tax code from one which seeks to tax income earned all over the world to one which only seeks to tax income earned in America. This is known as “territoriality,” and it’s already been adopted by and large by our trading competitors. By retaining a worldwide tax regime, we’re exposing our own countries to double taxation–once when they pay the foreign nation’s income tax, and again when they try to bring the money home.

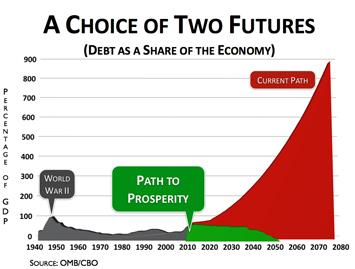

This is what the budget does: (Debt as % of GDP)

Doug Ross has three nice charts explaining the details.

Is Barack Obama going to do anything about the debt?

According to CBS News, Obama has exploded our national debt, so there is no reason to trust anything he says about reducing the debt.

Excerpt:

The National Debt has now increased more during President Obama’s three years and two months in office than it did during 8 years of the George W. Bush presidency.

The Debt rose $4.899 trillion during the two terms of the Bush presidency. It has now gone up $4.939 trillion since President Obama took office.

The latest posting from the Bureau of Public Debt at the Treasury Department shows the National Debt now stands at $15.566 trillion. It was $10.626 trillion on President Bush’s last day in office, which coincided with President Obama’s first day.

The National Debt also now exceeds 100% of the nation’s Gross Domestic Product, the total value of goods and services.

Mr. Obama has been quick to blame his predecessor for the soaring Debt, saying Mr. Bush paid for two wars and a Medicare prescription drug program with borrowed funds.

The federal budget sent to Congress last month by Mr. Obama, projects the National Debt will continue to rise as far as the eye can see. The budget shows the Debt hitting $16.3 trillion in 2012, $17.5 trillion in 2013 and $25.9 trillion in 2022.

[…]His latest budget projects a $1.3 trillion deficit this year declining to $901 billion in 2012, and then annual deficits in the range of $500 billion to $700 billion in the 10 years to come.

If Mr. Obama wins re-election, and his budget projections prove accurate, the National Debt will top $20 trillion in 2016, the final year of his second term. That would mean the Debt increased by 87 percent, or $9.34 trillion, during his two terms.

Some of Bush’s debt total can be explained by considering that Nancy Pelosi and Harry Reid raised the debt by $5 trillion dollars over 4 years when they took control of the House and Senate in January of 2007. But they’re Democrats, and that’s what Democrats do.

Related posts

- Paul Ryan teams up with Democrat Ron Wyden to push Medicare reform plan

- Budget guru Paul Ryan discusses the economy at the Heritage Foundation

- Paul Ryan explains how raising taxes hurts job creation

- Paul Ryan explains why the millionaire tax causes unemployment to rise

- Paul Ryan: cut current spending, cap future spending and balance the budget

- Paul Ryan talks about the looming American debt crisis

- Where does Paul Ryan stand on foreign policy and social issues?

- Paul Ryan responds to his critics on Medicare reform

- What’s wrong with the American economy and how Paul Ryan would fix it

- Republican Paul Ryan proposes over 6 trillion in spending cuts

- Paul Ryan discusses economics at the liberal Brookings Institute

- Paul Ryan explains taxes and spending to Chris Matthews

- Paul Ryan takes on Democrat Brad Sherman on the worsening economy

- Paul Ryan debates Robert Reich on Larry Kudlow show

- Paul Ryan debates on the relationship between tax rates and job creation

- Paul Ryan talks about health care with Chris Matthews and Chris Wallace

- Videos of health care summit speeches by Ryan, Blackburn, Coburn and Alexander

- Paul Ryan discusses Obamacare and the federal budget

- Moderate George Will loves Paul Ryan’s plan for economic recovery

- Paul Ryan confronts Tim Geithner on Obama’s 1.56 trillion budget deficit

- Paul Ryan declares war on Obama’s record 1.56 trillion dollar budget deficit

- Paul Ryan explains the vision of conservativism