Dad sent me this excellent article from the Daily Caller.

Excerpt:

The government spent approximately $1.03 trillion on 83 means-tested federal welfare programs in fiscal year 2011 alone — a price tag that makes welfare that year the government’s largest expenditure, according to new data released by the Republican side of the Senate Budget Committee.

The total sum taxpayers spent on federal welfare programs was derived from a new Congressional Research Service (CRS) report on federal welfare spending — which topped out at $745.84 billion for fiscal year 2011 — combined with an analysis from the Republican Senate Budget Committee staff of state spending on federal welfare programs (based on “The Oxford Handbook of State and Local Government Finance”), which reached $282.7 billion in fiscal year 2011.

[…]According to the CRS report, which focused solely on federal spending for federal welfare programs, spending on federal welfare programs increased $563.413 billion in fiscal year 2008 to $745.84 billion in fiscal year 2011 — a 32 percent increase.

[…]The total federal spending on federal welfare programs vastly outpaced fiscal year 2011 spending on such federal expenditures as non-war defense ($540 billion), Social Security ($725 billion), Medicare ($480 billion), and departments such as Justice ($30.5 billion), Transportation ($77.3 billion) and Education ($65.486 billion) — a fact that alarmed the ranking member of the Senate Budget Committee, Alabama Sen. Jeff Sessions, who requested the report from CRS.

“These astounding figures demonstrate that the United States spends more on federal welfare than any other program in the federal budget,” Sessions wrote The Daily Caller in an email. “It is time to restore — not retreat from — the moral principles of the 1996 welfare reform. Such reforms, combined with measures to promote growth, will help both the recipient and the Treasury.”

When state spending on federal welfare programs — specifically Medicaid and the Children’s Health Insurance Program — was thrown into the mix, the amount spent on federal welfare increased 28 percent, from $798.813 billion in fiscal year 2008 to $1.028.54 trillion in fiscal year 2011.

“No longer should we measure compassion by how much money the government spends, but by how many people we help to rise out of poverty,” Sessions continued. “Welfare assistance should be seen as temporary whenever possible, and the goal must be to help more of our fellow citizens attain gainful employment and financial independence. This is about more than rescuing our finances. It’s about creating a more optimistic future for millions of struggling Americans.”

With food assistance spending increasing the most out of every category, Sessions, who has been sounding the alarm on the expanding food stamp rolls, noted that the Obama administration has allowed for the food stamp increase through misleading promotion and a disregard for self-reliance.

“The administration ludicrously argues that every five dollars in food stamp spending results in nearly 10 dollars in economic benefit. They insist that communities ‘lose out’ when more people don’t sign up for benefits,” Sessions noted. “[The United States Department of Agriculture] even awarded a recruitment worker for overcoming people’s ‘mountain pride.’ Is this a hopeful vision for the future? Do these priorities make our country stronger and our economy more secure?”

Do these numbers surprise you, because of what you hear from Obama and his allies in the media? Well, Democrats are always lying about how the Bush tax cuts caused the deficits. The truth is that revenues went up after the tax cuts because more wealthy invested their savings since they stood to keep more of the gains if their risks panned out. People invest more when they are allowed to keep more of the profit, if they get a profit. That’s how investing works – when you stand to gain more for the same risk, you risk more. And risking money in a business venture means MORE JOBS, since people get hired to take the risk, and do the work.

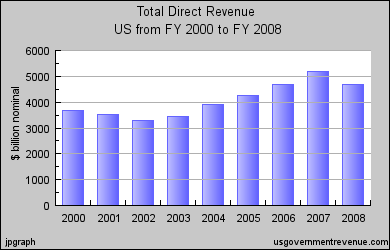

Bush’s tax cuts were passed in 2001 and 2003, and look what happened to revenues:

Not only that, but the unemployment rate went down to just over 4% after the tax cuts. The two wars cost about $550 billion, and we actually got national security out of it. What do we get for paying people not to work? Is it government’s job to pay people not to work? I think that charity is best done by individuals, businesses and especially churches, where we can expect some moral accountability from the recipient – some improved decision-making and personal responsibility. That’s simply lacking when government mails out checks paid for by working families and their employers.

Not every Republican is good on cutting spending, but Jeff Sessions is one of the Republican majority who opposes spending. We just just need to keep getting rid of the RINOs and Democrats, and this problem will get solved. We are never going to turn this economy around when people who think that more dependency and fewer jobs cause economic growth. They are wrong about the facts and they need to go in November.