UPDATE: Please vote “no” in this poll if you think tthat the Supreme Court is wrong.

Life Site News announces the death of religious liberty in Canada.

Excerpt:

In what’s sure to come down as a devastating blow to parental freedom, the Supreme Court of Canada unanimously rejected this morning the pleas of a Christian family to have their child exempted from the Quebec government’s mandatory ethics and religious culture course.

“Exposing children to a comprehensive presentation of various religions without forcing the children to join them does not constitute an indoctrination of students that would infringe the freedom of religion of L and J,” the justices wrote in the majority decision.

The high court’s ruling, released at 9:45 Friday morning, comes in the case of S.L. et al. v. Commission scolare des Chênes et al., which involved a Catholic family who took their school board to court after it refused to grant their child an exemption from the province’s controversial ethics and religious culture course (ERC).

The course, which seeks to present the spectrum of world religions and lifestyle choices from a “neutral” stance, was introduced by the province in 2008 and has been widely criticized by the religious and a-religious alike. Moral conservatives and people of faith have criticized its relativistic approach to moral issues, teaching even at the earliest grades, for instance, that homosexuality is a normal choice for family life.

Despite provincial legislation allowing for exemptions from school curriculum, the Ministry of Education has turned down over 1,700 requests, and had even moved to impose the course on private schools and homeschoolers.

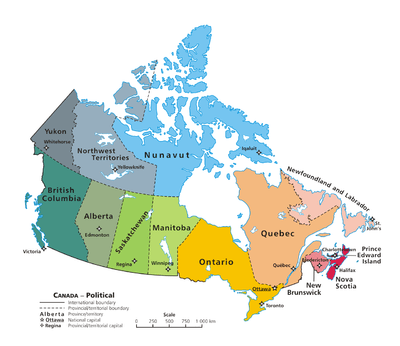

Critics warned that a ruling against the family would have frightening consequences for parental authority and risked emboldening provincial governments across the country as they move to impose their own versions of “diversity” education.

To me, what this means is that in Canada, the state decides what children will believe, not the parents. The state will tax parents in order to pay for government workers and government programs. And the state will use these government entities to make the children believe in the state’s values.

What is ironic to me is that Canadians likely voted to grow government. There are a lot of people in Canada who think that it is a good thing for government to help the poor. Many, many economically illiterate Christians also voted to grow the size of government over the last few decades. They voted to empty their own pockets by raising tax rates. They voted to entrust secular leftist bureaucrats with more and more power. They voted to let the state educate their children with public schools and government-run day care. They voted to let government provide health care instead of letting individuals earn and save to pay for it themselves. They voted for taxes that are so high that women cannot afford to stay at home and homeschool their children – they have to work and hand their children off to strangers.

It is very important for Christians to understand that if they believe that it is government’s job to redistribute wealth from rich to poor, then they voted for this. If you believe in “social justice” then you are opposed to religious liberty – and the free practice of Christianity itself. Many, many Christians who don’t study economics and don’t get their economic views from the Bible think that it is a good thing to vote for bigger and bigger government funded by higher and higher taxes. Christians in Canada seem to be proud of their self-inflicted secularism. They think that taxpayer-funded abortions and taxpayer-funded sex changes are a great idea – because “health care is a right”. They think that taxpayer-funded abortion and taxpayer-funded sex changes are authentic Christianity, supported by the Bible.

I have had Christians in Ontario tell me on Facebook that they are pro-life, pro-marriage and pro-family but that they favor allowing a secular government to force all taxpayers to pay for abortions and sex changes. That is what Canadian Christianity amounts to, in many cases – because they don’t understand economics, and what economic policies promote and secure rights – including the right to religious liberty. The right to religious liberty is only guaranteed when government is limited and the free enterprise system is strong. We need to stop deciding our views of politics and economics based on feelings and peer pressure and the desire to appear “compassionate”. We need to ask what the Bible says, and study economics in order to find out what guarantees the liberty we need to live out authentic Christian lives.

I think it’s time for Christians in Canada to get serious about applying the Bible to all of life – including economics.