If the underperformance of blacks and Hispanics in America were caused by racism by whites, then it follows that Asian-Americans would be underperforming as well. But Asian-Americans are outperforming whites. Let’s look at three reasons why, and see if blacks and Hispanics can learn how to succeed by looking at the Asian example.

Here is the summary of this post:

- Asian Americans marry before they have children

- Asian Americans save more of what they earn

- Asian Americans monitor their children’s educational progress

Now let’s take a look at each of these in order.

1. Asian Americans marry before they have children

This article is from Family Studies.

It says:

Eight in ten Asian-American kids live with married birth parents, compared with about seven in ten European-American kids, five in ten Hispanic-American kids, and only about three in ten African-American kids. Half of black children live with their mothers only, compared to three in ten Hispanic children, less than two in ten white children and less than one in ten Asian children.

Naturally, children who have two parents to look after them do better, because one parent alone cannot work and do household chores and monitor the children as easily as two parents can. The decision about whether to have sex before marriage is entirely under the control of the grown-ups. It cannot be blamed on racism, poverty and other non-moral pre-occupations of the secular left. Marriage is a moral issue, and Asian-Americans do the moral thing, and marry before they have children.

2. Asian Americans save more of what they earn

This article from CNN Money explains:

Asians have had higher median incomes than their white counterparts, according to a new study by the Federal Reserve Bank of St. Louis. The typical Asian family has brought home more money for most of the past two decades.

[…][Asians] will surpass whites in net worth in the next decade or two, Fed researchers said.

[…]In 1989, the median Asian family had about half the net worth of its white peer. By 2013, they had more than two-thirds.

The gap between whites and blacks and Hispanics, meanwhile, remained little changed over that time period.

Asians have similar financial habits to whites, in terms of investing and borrowing. Both groups are more likely than blacks and Hispanics to invest in stocks and privately-owned businesses and to have more liquid assets, which serves as a buffer against financial shocks. And, on average, the former have about half as much debt as the later.

As a result, Asians and whites have more financial stability than blacks and Hispanics, which also allows the former to build more wealth.

Everyone has to earn and save money, but in some cultures, it becomes normal to not save part of what you earn. That needs to stop. But it has nothing to do with discrimination due to skin color. In Asian culture, there is no glorification of consumer spending on sparkles, bling and other ostentatious wealth. Asians don’t want to appear to be wealthy, they want to actually be wealthy – by saving money.

3. Asian Americans monitor their children’s educational progress

This article from Investors Business Daily explains how Asian parents don’t just make demands on their kids to learn, they actively monitor their progress and talk to their kids’ teachers:

Asian-American parents tend to oversee their children’s homework, hold them accountable for grades and demand hard work as the ticket to a better life. And it pays off: Their children are soaring academically.

[…]As a group, Americans need to take a page from the Asian parents’ playbook. American teens rank a dismal 28th in math and science knowledge, compared with teens in other countries, even poor countries.

Singapore, Hong Kong, South Korea, Japan and Taiwan are at the top. We’ve slumped. For the first time in 25 years, U.S. scores on the main test for elementary and middle school education (NAEP) fell. And SAT scores for college-bound students dropped significantly.

[…]Many [Asian students]from poor or immigrant families, but they outscore all other students by large margins on both tests, and their lead keeps widening.

In New York City, where Asian-Americans make up 13% of overall students, they win more than 50% of the coveted places each year at the city’s eight selective public high schools, such as Bronx Science and Stuyvesant.

What’s at work here? It’s not a difference in IQ. It’s parenting. That’s confirmed by sociologists from City University of New York and the University of Michigan. Their study showed that parental oversight enabled Asian-American students to far outperform the others.

No wonder many successful charter schools require parents to sign a contract that they will supervise their children’s homework and inculcate a work ethic.

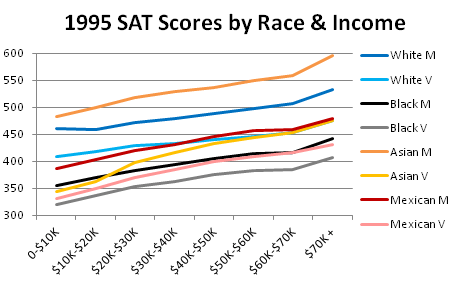

You can see an updated image with the latest scores here.

It’s not enough to just outsource the education of your children to a bunch of non-STEM education-degree-holding teachers. Teachers can be good, and some work very hard. But the Democrat teacher unions prevent the firing of teachers who underperform. This is especially true in non-right-to-work states (Democrat states). So, you cannot depend on teachers to educate your children, and Asian parents don’t. That’s why their kids learn. Performance of children in school is not affected by discrimination against skin color, it’s affected by the level of involvement of parents.

Conclusion

We have learned that the success of Asian-Americans in America is all earned. And this proves that there is no such thing as “racism” that holds back non-whites. If blacks and Hispanics imitated the behaviors of Asians (not whites, but Asians), then they would achieve just as well as Asians do. It’s not a race problem, it’s a behavior problem. It’s not a “racism” problem, it’s a behavior problem. It’s an us problem, it’s not a them problem.