The presidents of my two favorite think tanks, Arthur Brooks (AEI) and Edwin Feulner (Heritage) explain in this USA Today editorial.

Excerpt: (links removed)

First, there is no evidence that tax increases will actually solve our troubles. On the contrary, years of data from around the world show that when nations try to solve a fiscal crisis primarily by raising tax revenues, they tend to fail. In contrast, fiscal approaches based on entitlement reform and spending cuts tend to succeed.

American Enterprise Institute economists Kevin Hassett, Andrew Biggs and Matthew Jensen examined the experiences of 21 Organization for Economic Cooperation and Development (OECD) countries between 1970 and 2007. They found that countries with successful fiscal reforms, on average, closed 85% of their budget gaps with spending cuts. The countries with failed reforms, on average, relied at least 50% on tax increases. President Obama’s strategy falls firmly in the latter camp. After discounting the accounting tricks that create fictitious spending cuts, the president’s plan would impose about $3 in tax hikes for every $1 in spending cuts.

That is, his approach would probably land America in the “failed attempt” column. Five years down the line, we would be in the same fiscal mess we are in today, just with higher taxes and a bigger government.

Second, tax hikes aimed at small segments of the population wouldn’t raise much in revenues. Consider the “Buffett Rule” that the president spent many months promoting. According to the Joint Committee on Taxation, it would raise about $47 billion over a decade. The federal government currently spends about $4 billion more per day than it takes in. The Buffett Rule, then, would raise about enough next year to cover 28 hours of government overspending. Heritage Foundation economist Curtis Dubay finds that closing the deficit solely by raising the two highest tax brackets would require hiking them to 159% and 166%, respectively.

Third, as economists and business executives have noted repeatedly, raising taxes on families earning over $250,000 per year is effectively a massive tax hike on small businesses. Most small businesses today organize as S-corporations or other pass-through entities; their income is taxed as personal income. A study by Ernst and Young shows that Obama’s proposed tax hike would force these small businesses to eliminate about 710,000 jobs. Moreover, these households already bear a great deal of tax liability. According to the most recent Internal Revenue Service data, those earning $250,000 and above — roughly 2% of all taxpayers — earn 22% of income, but pay 45% of all federal income taxes.

Simply put, increasing tax rates on the wealthy is not a serious approach to solving America’s fiscal woes. The problem is purely one of excessive spending, not inadequate taxing.

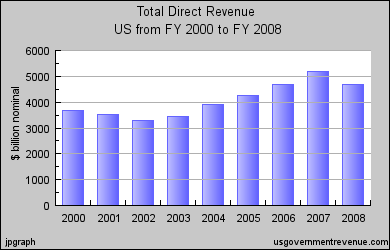

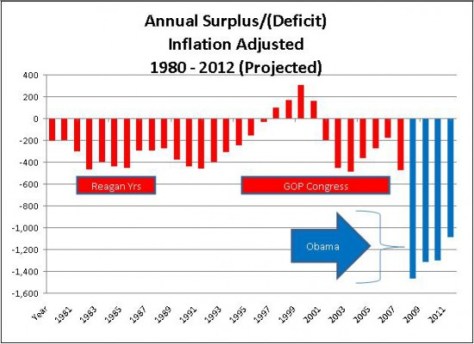

Revenues haven’t changed substantially over the last decade, but government spending is way, way up. That’s what’s causing us to go into debt – massive government spending on turtle tunnels and Solyndra. We can do better than socialism.