First of all, Obama’s budget ensures that future generations will be saddled with debt, paying for the entitlement programs (Social Security and Medicare) of their aging parents and grandparents.

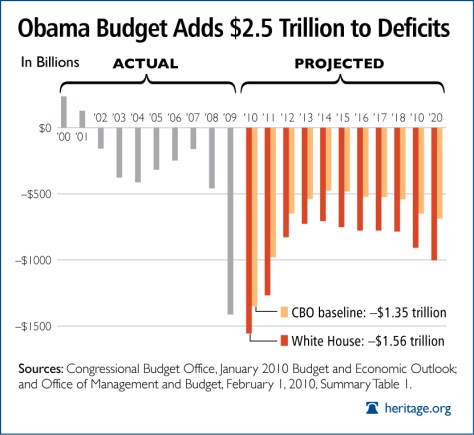

Behold, the evidence of generational theft:

(Click for larger image)

Recall that the Democrats gained control of Congress at the beginning of 2007.

The second way that Obama’s budget hurts the poorest children is by denying them the right to access better schools.

Excerpt:

The president’s proposed FY2011 budget increases funding to the Department of Education by $3.5 billion. But despite this significant increase, his budget effectively cuts the freedom of choice and educational opportunities from the lives of children living in the District of Columbia. What began last year as a low-profile attempt to quietly phase out the D.C. Opportunity Scholarship Program has become a noticeable agenda of denying school choice to District families.

[…]The most recent casualty in the struggle to save the successful voucher program’s future is Holy Redeemer Catholic School. The Pre-K through 8th grade school, which has served the community of Northwest Washington, D.C. since 1955, is closing its doors. The Washington, D.C. Archdiocese’s decision to close or combine four Catholic schools in the area speaks to the difficult situation face by Catholic schools in general and the important role voucher programs play in the schools’ ability to provide a high quality, private school education.

This is in spite of the fact that school choice works.

Excerpt:

A recent report from School Choice Wisconsin presented an analysis of the number of calls made to 911 from schools in Milwaukee, similar to a Heritage analysis from last summer written up in The Washington Post. The Milwaukee School Safety report found that choice schools appeared to be relatively safer than Milwaukee’s traditional public schools:

Taking into account enrollment differences, police calls to [Milwaukee public schools] occur at a notably higher rate than at independent charter schools or at schools in the [Milwaukee parental choice program]. The [Milwaukee Public School] call rate per pupil in 2007 is more than three times that at schools in the [Milwaukee Parental Choice Program].

In addition, a new report out this week from Dr. John Robert Warren of the University of Minnesota analyzed the graduation rates of students attending high schools in Milwaukee, comparing the graduation rate of students participating in the school voucher program with the graduation rate of students who attend traditional public schools in the city. Warren found that during the 2007-08 school year, 77 percent of students in the school voucher program graduated compared to 65 percent in the traditional Milwaukee public school system.

Obama is in the pocket of the teacher unions, and he must ensure that they keep their jobs regardless of failure, so that the teacher unions can continue to contribute union dues into Democrat coffers. He doesn’t care about children – he cares about getting elected. It’s just another way that the irresponsible grown-ups attack the things that children need to succeed: a good education, low taxes, a job, and an intact family.