From Erick Erickson at Red State. (H/T IHateTheMedia via ECM)

Excerpt:

Barack Obama and his administration are about to significantly drive up the costs of federal building construction. This is an astonishing reach. The Office of Management and Budget has directed that any federal construction over $25 million benefit unions.

The order would make all federal construction projects 10-20% more expensive by requiring all contractors to either use union workers or apply inefficient union apprenticeship and work rules to their employees. Contractors would also be required to make contributions to union pension funds and other union programs that non-union workers will never benefit from.

This will hugely drive up the cost of construction of federal buildings and line the pockets of unions without even having union workers involved in the projects. The Bureau of Labor Statistics shows that only 15.6% of private construction workers in America belong to unions. In other words, 8 out of 10 construction workers in America will be legally denied the right to work on federal building projects.

Now you say to me, “Wintery! What’s wrong with unions?”

And I refer you to this article from the extremely leftist NYT. (H/T Sweetness and Light via ECM)

Excerpt:

No one got the chance to say goodbye to Café des Artistes, the storied New York City restaurant that served up Old World fare under the gaze of the painted nubile nudes that perkily graced its walls.

The restaurant had closed on Aug. 9 for a month-long vacation and was to reopen Sept. 14. But on Friday, facing steady losses and a union lawsuit, its owners made what they described as a wrenching decision to close the landmark cafe on West 67th Street for good.

“It’s a very sad day for us,” said Jenifer Lang, whose husband, George Lang, has owned the restaurant since 1975. “It’s a death in the family.”

It was also the death of an intrinsic part of old New York. Countless couples got engaged in the glow of the restaurant’s dim, romantic lighting…

Mrs. Lang, 58, said that the restaurant’s business had been hurt by the economic crash but that its problems ran deeper. Café des Artistes was unionized, and she said the restaurant paid about $250,000 a year to cover its employees’ health and pension benefits, an amount she said the restaurant struggled to cover. Mrs. Lang also said the couple, whose home is half a block from the restaurant, put in $2 million of their own money to keep it running over the last 10 years.

“It makes it difficult to run a restaurant most of the time,” Mrs. Lang said of the union benefits. “When the economy is down, it makes it impossible.”

The final straw, Mrs. Lang said, was a lawsuit recently filed against the restaurant by the union demanding past benefit assessments.

Bill Granfield, president of Local 100 of Unite Here, the union representing the cafe’s 50-odd employees, said the restaurant had fallen behind on its payments for medical insurance and welfare funds, forcing the union to demand payment in court. He also said workers in 2003 took a pay cut and agreed to switch to a cheaper medical plan to ease the restaurant’s financial pressures…

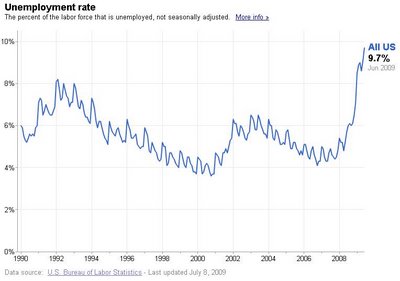

Unions kill jobs by raising the price of labor with no compensating rise in worker productivity. When you raise the price of labor, businesses die. When businesses die, unemployment goes up. That’s the way the world works.