From the American Enterprise Institute.

Here’s the summary of the list of 9 items:

- Unemployment rate

- Declining U.S. labor force (structural unemployment/government dependency)

- Labor force participation rate

- Unemployment/population ratio

- Average hourly earnings of workers

- GDP growth

- Economic competitiveness

- Federal debt crisis

- Risk of renewed recession

And here’s the detail of one that I haven’t mentioned much before on this blog:

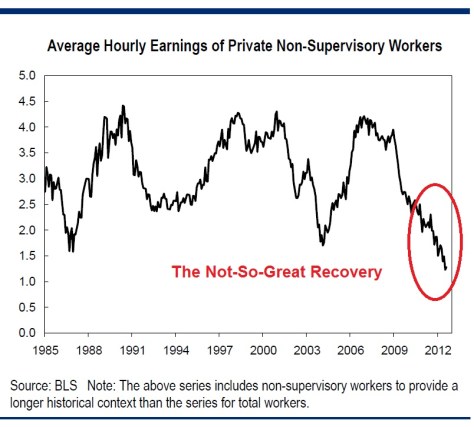

5. Average hourly earnings were unchanged in the August jobs report, and are up just 1.7% over the past year. Not only does that match the slowest pace on record, but one you account for inflation, wages are flat to down.

The graph:

According to Forbes magazine: (H/T Gateway Pundit)

New income data from the Census Bureau reveal what a great job Barack Obama has done for the middle class as President. During his entire tenure in the oval office, median household income has declined by 7.3%.

In January, 2009, the month he entered office, median household income was $54,983. By June, 2012, it had spiraled down to $50,964. That’s a loss of $4,019 per family, the equivalent of losing a little less than one month’s income a year, every year. And on our current course that is only going to get worse not better…

[…]Three years into the Obama recovery, median family income had declined nearly 5% by June, 2012 as compared to June, 2009. That is nearly twice the decline of 2.6% that occurred during the recession from December, 2007 until June, 2009. As the Wall Street Journal summarized in its August 25-26 weekend edition, “For household income, in other words, the Obama recovery has been worse than the Bush recession.”

[…]Obama has failed the poor as well as the middle class. Last year, the Census Bureau reported more Americans in poverty than ever before in the more than 50 years that Census has been tracking poverty. Now The Huffington Post reports that the poverty rate is on track to rise to the highest level since 1965, before the War on Poverty began. A July 22 story by Hope Yen reports that when the new poverty rates are released in September, “even a 0.1 percentage point increase would put poverty at the highest level since 1965.”

Gateway Pundit adds:

Barack Obama is not just the food stamp president.

A record one in seven Americans is on food stamps today thanks to Barack Obama.Barack Obama is also the poverty and pain president.

Under Obama, 6.4 million Americans are living below the poverty line and there is a record number of Americans living in deep poverty.

Meanwhile, Moody’s is threatening a credit downgrade:

Moody’s Investors Service said Tuesday that it would probably cut its triple-A rating on U.S. government debt by a notch unless congressional leaders can strike a budget deal in the coming months to bring down the deficit.

“If those negotiations lead to specific policies that produce a stabilization and then downward trend in the ratio of federal debt to GDP over the medium term, the rating will likely be affirmed,” Moody’s said in a press release Tuesday. “If those negotiations fail to produce such policies, however, Moody’s would expect to lower the rating, probably to Aa1.”

The threat comes after one of the other big three ratings firms, Standard & Poor’s, downgraded the U.S. last year following the brawl in Washington over the debt ceiling.

This would be the second credit downgrade – both occurred because of Obama’s Marxist policies of “spreading the wealth around” to punish job creators and their employees.

Are you better off now than you were four years ago?