Here’s an interesting editorial from a “Christian” left blog. (H/T Acton Institute)

The author, Tad Hopp is graduating a PCUSA seminary – an extremely liberal, left-wing denomination.

He writes:

I graduated college in 2007.

[…] I majored in English, not exactly what most people consider a ‘marketable’ or ‘practical’ degree…

[…]I went to a somewhat expensive private school…

[…]I did what many students in their last year of high school do: I went to the school where I felt I was being called…

[…]I do not regret my four years at my undergraduate institution one bit.

[….]When I graduated college, I owed nearly $50,000 in student loan debt and was unemployed for almost six months before I finally found a low-paying office job.

[…]“Can’t find a job? Well, you should have majored in something more ‘practical’, like economics or business or medicine.” Yeah, that would be great…if those were the subjects where my skills and passions lie. They’re not.

[…]I felt called to go to seminary.

[…]I will graduate seminary with close to six figures worth of student loan debt.

Let’s take stock of what he’s said so far:

- he studied English, a language that he already spoke, which has one of the lowest employment rates

- he was warned by people who knew something about earning and saving money not to study English

- he went to a school he couldn’t afford to go to, and he graduated with $50,000 in debt

- he went to seminary, another subject that doesn’t pay, and added another $50,000 or so of debt

- he says that he doesn’t have to study subjects that lead to a career because he isn’t “passionate” about them

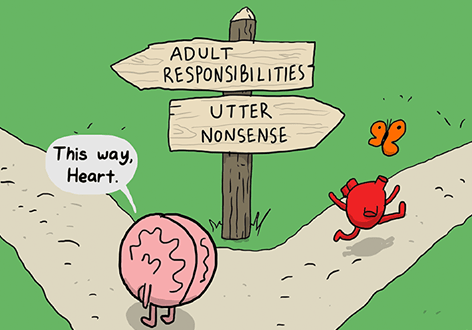

- he “followed his heart” by going to the school that he had mystical, emotional, intuitions about = “calling”

My advice to Tad at this point would be for him to take the Bible seriously when it says this:

2 Thessalonians 3:10:

10 For even when we were with you, we used to give you this order: if anyone is not willing to work, then he is not to eat, either.

And 1 Timothy 5:8:

8 But if anyone does not provide for his own, and especially for those of his household, he has denied the faith and is worse than an unbeliever.

The Bible is giving us the goal of working. So what should we do to be able to reach that goal? Why should anyone hire us? What is working really about? It’s those kinds of questions that should guide what we study in school, and what jobs we pursue.

We know what careers have the highest starting salaries and mid-career salaries:

1. Computer Science

- Median Base Salary: $70,000

- Popular Entry-Level Jobs: Software Engineer, Systems Engineer, Web Developer

2. Electrical Engineering

- Median Base Salary: $68,438

- Popular Entry-Level Jobs: Electrical Engineer, Systems Engineer,Software Developer

3. Mechanical Engineering

- Median Base Salary: $68,000

- Popular Entry-Level Jobs: Mechanical Engineer, Design Engineer,Project Engineer

4. Chemical Engineering

- Median Base Salary: $65,000

- Popular Entry-Level Jobs: Chemical Engineer, Process Engineer, Project Engineer

5. Industrial Engineering

- Median Base Salary: $64,381

- Popular Entry-Level Jobs: Industrial Engineer, Quality Engineer, Production Planner

6. Information Technology

- Median Base Salary: $64,008

- Popular Entry-Level Jobs: Programmer Analyst, Technical Support, Systems Engineer

7. Civil Engineering

- Median Base Salary: $61,500

- Popular Entry-Level Jobs: Civil Engineer, Structural Engineer, Field Engineer

8. Statistics

- Median Base Salary: $60,000

- Popular Entry-Level Jobs: Data Analyst, Statistician, Data Scientist

9. Nursing

- Median Base Salary: $58,928

- Popular Entry-Level Jobs: Registered Nurse, Licensed Vocational Nurse, Case Manager

10. Management Information Systems

- Median Base Salary: $58,000

- Popular Entry-Level Jobs:Network Administrator, Help Desk Analyst, Business Analyst

11. Finance

- Median Base Salary: $54,900

- Popular Entry-Level Jobs: Financial Analyst,Investment Banking Analyst, Accountant

12. Mathematics

- Median Base Salary: 54,018

- Popular Entry-Level Jobs: Math Teacher, Software Engineer, Data Analyst

13. Biomedical Engineering

- Median Base Salary: $52,814

- Popular Entry-Level Jobs: Biomedical Engineer, Service Engineer, Clinical Research Associate

14. Accounting

- Median Base Salary: $52,000

- Popular Entry-Level Jobs: Accountant, Auditor, Financial Analyst

15. Economics

- Median Base Salary: $52,000

- Popular Entry-Level Jobs: Financial Analyst, Management Analyst, Accountant

16. Physics

- Median Base Salary: $50,000

- Popular Entry-Level Jobs: Physicist, Research Fellow, Computer Programmer

17. Biotechnology

- Median Base Salary: $50,000

- Popular Entry-Level Jobs: Laboratory Technician, Quality Control Analyst, Research Associate

(Source)

Why do some people get paid more than others? The answer is supply and demand. Prices are a way of determining what is most valued by your fellow man. Business owners pay more to people who offer their customers more value. If you really want to serve your neighbor, you have to learn something they really want, but can’t easily obtain. And then you will be paid more. You can’t do what makes you happy. You have to do what makes customers happy. That’s how the free market works – you make money when you provide something of value to others. You make money when you serve others. This is something that is very hard for self-centered, feelings-driven young progressives to grasp. But it’s something older Americans all know.

More Tad:

Is the PCUSA doing anything to address this crisis?

[…]What has our government done to address this issue?

[…]I, like so many in my generation, voted for Obama…

[…]It seems to me that we’ve bought into the lie that student loan debt is brought on by the individual person…

[…]You know what I think might stimulate the economy? Automatically cancelling every single outstanding student loan!

He insists that the results of his own choices aren’t his fault. But didn’t he make the choices about what to study? Didn’t he make the choice to follow his heart? Didn’t he disregard the advice of people who urged him to be practical? Who is to blame, if not he, himself?

Tad needs to push away all his friends who told him to “follow his heart” and stick close by his friends who told him to focus on providing value to others. Don’t look for advice from dreamers, look for advice from doers. Dreamers talk. But doers have demonstrated the ability to create plans that work to achieve results.

By the way, some of you might be wondering how serious this person was about his Christianity. Well, in another post, he comes out as gay. So clearly the Bible is being interpreted in a way where feelings are overturning the plain meanings of words. People who read the Bible closely never come away with the message that they should follow their hearts.