From Investor’s Business Daily.

Excerpt:

As solar panel manufacturer Solyndra was sliding into a long-predicted bankruptcy, Energy Department officials began negotiations with the company and two of its main investors about restructuring its $535 million loan to keep afloat the business that was supposed to be a good investment.

Under the restructuring agreement, Solyndra’s private investors were moved to the front of the line and taxpayers were put on the hook for at least the first $75 million if the company should default. Subordinating taxpayers to private investors in recovering loan money is an “apparent violation of the law,” according to Fred Upton, R-Mich., chairman of the House Energy and Commerce Committee.

During hearings last week, Rep. Steve Scalise, R-La., and other Republicans noted that the Energy Policy Act of 2005 says obligations, or loan guarantees, shall not be subordinated to other financing.

In other words, taxpayers get first dibs on any money recovered and private investors take a number.

Why was the Solyndra loan restructured in this way? Was it because a major donation bundler for President Obama’s 2008 campaign was also a principal investor in Solyndra? Is that why the administration ignored repeated warning’s of Solyndra’s insolvency?

A 2009 report by the Energy Department’s inspector general warned that DOE lacked the necessary quality control for the $38.6 billion loan-guarantee program. In July 2010, the Government Accountability Office said DOE had bypassed required steps for funding awards to five of 10 loan recipients.

[…]Solyndra was the third U.S. solar manufacturer to fail in a month. SpectraWatt Inc., a solar company backed by units of Intel Corp. and Goldman Sachs Group Inc., filed for bankruptcy protection Aug. 19, and Evergreen Solar filed Chapter 11 on Aug. 15.

Other failed companies receiving stimulus funds include Mountain Plaza Inc., which took $424,000 in grants to install “truck stop electrification systems” so truckers could plug in and shut off their idling diesel engines, and Olsen’s Crop Service and Olsen’s Acquisition Co., which were handed $10 million.

[…]The administration claims that as a whole this loan guarantee program, which was supposed to create 65,000 jobs, was a success, creating or “saving” some 44,000 jobs. An analysis by the Washington Post says the actual number of permanent jobs created is 3,545.

[…]Even if you accept the administration’s questionable job accounting, divide the $38.6 billion by 65,000 and ask yourself if the administration is spending your money wisely — or honestly.

The Obama administration has already spent about half of the 38.6 billion set aside for Democrat cronies. I mean green energy. If you divide 17.5 billion by 3,545 jobs created, that’s $5 million per job. That’s sound Democrat fiscal policy. Bible-thumping morons like Sarah Palin and Michele Bachmann could never think of intelligent policies like spending $5 million per job created. To get to that level of intelligence, you need to have degrees from Columbia and Harvard Law School (grades never released). And to vote for Obama’s policies, you need to be smart enough to watch the Jon Stewart and Stephen Colbert on the Comedy Channel, and think that it’s news.

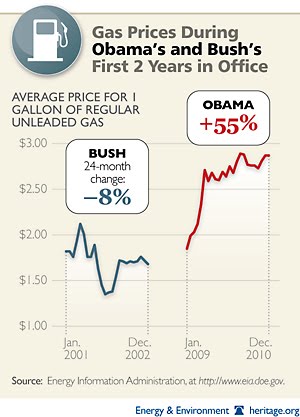

So we took billions of dollars out of the private economy, in order to punish those evil oil companies and coal companies, and we spent it on magic beans – sold to us by Obama’s Democrat cronies. Instead of lowering energy prices, Obama’s policies have resulted in higher energy prices. Was this unexpected?

Actually, for anyone who was paying attention, Obama made clear that he was OK with higher energy prices before he was elected in 2008.

And that’s what we got:

Only two kinds of people voted for Obama in 2008 – the people who were informed about Obama’s record by watching Ed Schultz and Rachel Maddow on MSNBC, and the people who were about to receive stimulus grants for the green energy companies. The people who think that Michael Moore tells the truth about health care, and that Al Gore is an authority on climate science. The people who think that the New York Times is unbiased news.