Here’s a story from the House Budget Committee, where Paul Ryan is the leader.

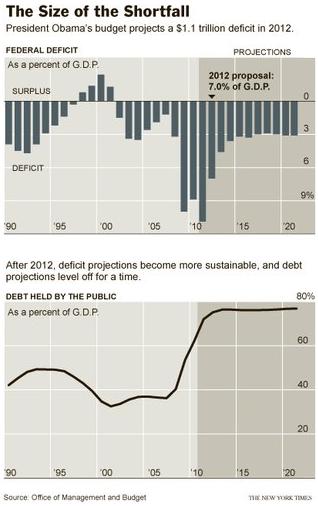

Paul Ryan made these two charts to help him discuss Obama’s new budget with Obama’s budget director.

And:

Watch these clips to see Paul Ryan and Scott Garrett use the charts to do nasty things to Obama’s budget director.

Clip 1 of 3:

Clip 2 of 3:

Clip 3 of 3:

Guy Benson discusses both videos at Townhall.com.

Excerpt:

Ryan does a masterful job of puncturing Zients’ arguments, but let’s reiterate a few points that may have gotten lost in the shuffle.

(1) The White House is claiming that spending cuts within the Budget Control Act of 2011 — which is entirely separate from the FY 2013 budget — should count as savings “achieved” by their new proposal. This is silly on its face, but crosses into laughable territory when one recalls that throughout much of the debt fight, President Obama adamantly opposed a cuts-for-debt-ceiling-hike quid pro quo. He was on the record in favor of — demanding, in fact — zero cuts. Republicans dragged him into the BCA against his will; now he’s trying to take credit for that past action in next year’s budget.

(2) The White House says Obama’s budget “saves” $850 Billion by not fighting two wars at peak spending levels for another full decade. This money was never proposed because the scenario is pure fiction. These risible “savings” represent a White House bear-hug of Moon-Yogurt accounting. “Heaven help us” is right.

(3) Zients’ isn’t able to recall how much money this budget adds to the national debt. You’d think the White House Budget Director would have that figure committed to memory (he likely does, but doesn’t want to admit it on camera), but let’s help him out: The budget he’s defending adds nearly $11 Trillion to the debt, on top of the roughly $5 Trillion increase over which this president has already presided. I seem to recall an infamous Right-wing zealot calling this sort of governance “unpatriotic.”

Next, we have Rep. Scott Garrett, a strong conservative from Northern New Jersey, asking Zients when the president’s budget comes into balance. Zients refuses to directly respond to the question, perhaps because the correct answer is “never”…

Indeed, the closest Obama’s budget ever comes to balancing (expenses = revenues) within the ten-year projection window is 2017’s annual deficit of $617 Billion, which is still more than double the size of President Bush’s average annual deficit. Finally, Garrett lures Zients into a trap over Obamacare. Garrett asks if a family making less than $250,000 per year (“the rich” cut off) is subject to a tax increase if they fail to comply with Obamacare’s individual mandate…

The president sold Obamacare to the public by characterizing the resulting mandatory pay-out as a “fine,” not a tax increase. He even mocked George Stephanopoulos’ suggestion that it met the dictionary definition of a tax hike. Once the law passed, however, the administration’s lawyers pulled an about-face and have defended the mandate in court by arguing that the fine is, in fact, a tax increase after all. Zients has apparently reverted back to the outmoded argument, thus undermining his own administration’s legal defense of their signature “accomplishment.”

What I find frustrating is the media does such a poor job of vetting these “4 trillion dollar” claims that Obama makes. Sometimes, I wonder why anyone listens to mainstream media at all. What do you really learn?