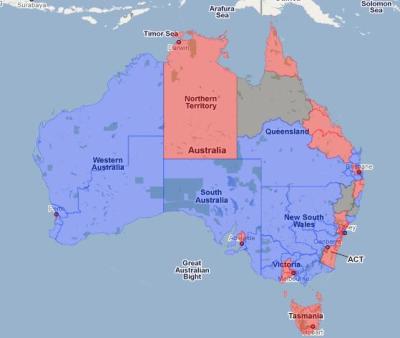

I was disappointed with Queensland because of the last federal election in 2010. They elected several Labor Party MPs. And now the federal Labor Party is pushing for a carbon tax and gay marriage, too.

Look what happened in 2010:

| Party | Votes | % | Swing | Seats | Change | |

|---|---|---|---|---|---|---|

| Australian Labor Party | 1,020,665 | 42.91 | +8.13 | 15 | +9 | |

| Liberal Party of Australia | 818,438 | 34.40 | –5.01 | 10 | –7 | |

| National Party of Australia | 239,504 | 10.07 | +0.32 | 3 | –1 | |

| Australian Greens | 133,938 | 5.63 | +0.57 | 0 | 0 | |

The Liberal Party and the National Party are the two conservative parties – they form a conservative coalition, and they continued to lose seats, just like they did in 2007.

Given that, I was heartened by the results from this past weekend, when Queensland held state-level elections. (H/T Bill M.)

Excerpt:

[Opposition leader] Tony Abbott has sought to capitalise on the Queensland election saying Labor MPs right across the country will be worried about the “fundamental lesson” from yesterday’s landslide defeat.

Speaking on Sky News’s Australian Agenda the Opposition Leader said Labor needed to have a “good, long, hard look at itself” and said the party’s brand was “toxic” around Australia.

“This is a triumph for Campbell (Newman) and the LNP,” Mr Abbott said this morning of the Queensland result.

“I think Labor members of parliament right around Australia would be very worried about the fundamental lesson from this which is that a government which isn’t competent, which isn’t frugal and which isn’t truthful loses and loses big time.

“The basic message is that the Labor brand is toxic right around Australia.”

“Certainly there were two candidates for Queensland one of them Anna Bligh, who was for the carbon tax, and the other Campbell Newman who was against it,” Mr Abbott said.

Mr Newman’s Liberal National Party ended Labor’s 14-year reign in Queensland last night with a crushing win.

The latest forecasts have the LNP winning as many as 78 seats in the 89-seat parliament, with Labor expected to hold just seven seats of its former 51.

Mr Abbott said while the Queensland election had buoyed the Coalition’s hopes of winning the next federal election he conceded things could be different if Julia Gillard improves.

“If the federal Labor government is able to lift its game and be truthful, yes things could be different,” the Opposition Leader said.

“But I think federal Labor has clearly established its character.”

Mr Abbott stood by his comments last week that the Queensland election would be a referendum on the carbon tax and dishonest politicians.

Those results are now final – Labor went from 51 seats to 7 seats! This is as bad as what happened to the leftist Liberal Party in Canada in 2011.

Let’s hope that Julia Gillard, the head of the Australian Labor party, doesn’t learn anything from this and continues to push for left-wing fiscal and social policies. Tony Abbott is quite awesome in general, so they do have a good candidate running against her whenever the next election is held.