The Wall Street Journal reports.

Excerpt:

The recovery that began four years ago has been one of the weakest on record, averaging a little more than 2%. And it has not gained speed. Growth in the fourth quarter of 2012 was 0.4%. It rose to a still anemic 1.8% in the first quarter but most economists are predicting even slower growth in the second quarter.

We hope the predictions of a faster growth in the second half will be right, but the Obama Treasury and Federal Reserve have been predicting for four years that takeoff was just around the corner. Stocks are doing great, and housing prices are rising, but job growth remains lackluster. What has never arrived is the 3%-4% growth spurt during typical expansions.

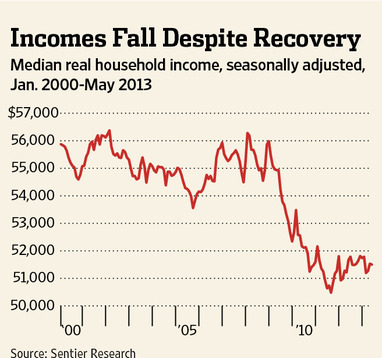

[…]What about the middle class that is the focus of Mr. Obama’s rhetoric? Each month the consultants at Sentier Research crunch the numbers from the Census Bureau’s Current Population Survey and estimate the trend in median annual household income adjusted for inflation. In its May 2013 report, Sentier put the figure at $51,500, essentially unchanged from $51,671 a year earlier.

And that’s the good news. The bad news is that median real household income is $2,718, or 5%, lower than the $54,218 median in June 2009 when the recession officially ended. Median incomes typically fall during recessions. But the striking fact of the Obama economy is that median real household income has fallen even during the recovery.

While the declines have stabilized over the last two years, incomes are still far below the previous peak located by Sentier of $56,280 in January 2008. No wonder Mr. Obama is now turning once again to his familiar political narrative assailing inequality and blaming everyone else for it. He wants to change the subject from the results on his watch.

The core problem has been Mr. Obama’s focus on spreading the wealth rather than creating it. ObamaCare will soon hook more Americans on government subsidies, but its mandates and taxes have hurt job creation, especially at small businesses. Mr. Obama’s record tax increases have grabbed a bigger chunk of affluent incomes, but they created uncertainty for business throughout 2012 and have dampened growth so far this year.

The food stamp and disability rolls have exploded, which reduces inequality but also reduces the incentive to work and rise on the economic ladder. This has contributed to a plunge in the share of Americans who are working—the labor participation rate—to 63.5% in June from 65.7% in June 2009. And don’t forget the Fed’s extraordinary monetary policy, which has done well by the rich who have assets but left the thrifty middle class and retirees earning pennies on their savings.

Mr. Obama would have done far better by the poor, the middle class and the wealthy if he had focused on growing the economy first. The difference between the Obama 2% recovery and the Reagan-Clinton 3%-4% growth rates is rising incomes for nearly everybody.

And remember, thanks to Obamacare, medical insurance premiums have soared over $3,000. We are getting poorer because of Obama’s big government policies.

Whose fault is it?

In the 2006 mid-term elections, the Democrats took over the House and Senate. That was the beginning of the Nancy Pelosi and Harry Reid spending spree. Millions of dollars have been wasted on ineffective government programs, handouts and bailouts. We’ve had trillion dollar deficits for the last four years under Obama, and over 8 trillion added to the national debt since Pelosi/Reid 2007. All that deficit spend does have an effect on economic growth – businesses know that they are going to have to pay it off at some point, either through higher taxes or inflation or both.