FrontPage Magazine explains.

Excerpt:

When the president’s 13-year-old daughter, Malia, took a Spring Break trip to Mexico with 12 of her friends and 25 Secret Service agents–one that reportedly cost taxpayers $2.5 million–it was covered by the mainstream media. AFP filed the initial report, and the story was subsequently picked up by Yahoo, the Huffington Post, and the International Business Times, as well as foreign publications, such as Daily Mail, the Telegraph and The Australian.

Yet by the same evening, all of the stories had been removed from each of those sites. The updated links either directed one to a site’s home page or 404 error pages, reading “page not found.” What happened? The White House got a compliant media to scrub the story. Kristina Schake, Communications Director to the First Lady, confirmed this to Politico: “From the beginning of the administration, the White House has asked news outlets not to report on or photograph the Obama children when they are not with their parents and there is no vital news interest. We have reminded outlets of this request in order to protect the privacy and security of these girls.”

Again, such concerns for the safety of First Family members are entirely legitimate. Yet some questions remain unanswered. Why would the president allow his daughter to travel to Mexico despite a Texas Department of Public Safety warning not to go there because “cartel violence and other criminal activity represent a significant safety threat, even in some resort areas”? Why was it necessary to include a dozen friends, making the trip more expensive and security far more complicated? Why are members of the mainstream media taking marching orders from the White House? Why did the trip costtaxpayers $2.5 million?

Perhaps, as the saying goes, the apple doesn’t fall far from the tree. Last week, Judicial Watch released a report revealing that First Lady Michelle Obama’s trip to Costa Del Sol, Spain in 2010 cost taxpayers $467,585. Again, no reasonable person begrudges a woman in the public spotlight some rest and relaxation. But as the New York Times reports, part of that R&R included a stay at the “five-star Hotel Villa Padierna near Marbella, where at least 30 rooms were reserved for the entourage, including those for security. The hotel is one of Spain’s more luxurious establishments, with rooms ranging from $500-a-night to a $6,600 suite with 24-hour butler service.”

Furthermore, Mrs. Obama is hardly reticent when it comes to taking vacations. Her February 2012 trip to upscale Aspen, Colorado, for a President’s Day ski weekend with daughters Sasha and Malia, marked the 16th vacation (the updated number is now 17) taken by Obama family members in just over three years, not including visits to the Camp David compound, or short trips like a New York City “date night” taken in May 2009. Nor is the First Lady or the president seemingly concerned saddling taxpayers with the cost of flying separately to the same vacation sites. It cost taxpayers $100,000 when the First Lady jetted to a 2010 Hawaii vacation ahead of her husband, and several thousands more when the First Lady traveled to a Martha’s Vineyard vacation on a separate government jet only four hours prior to the president’s trip there. While at Martha’s Vineyard, the First Family stayed at Blue Heron Farm, a property that reportedly rents for approximately $50,000 per week. And on a trip to Maine in July of 2010, the President’s dog, Bo, and his handler traveled on a separate plane to that destination.

Such a penchant for extravagance has added up to some pretty daunting numbers. The UK’s Daily Mail, citing White House sources who referred to the First Lady as “a vacation junkie,” claimed Michelle Obama had “has spent $10 million of U.S. taxpayers’ money on vacations alone in the past year”–as of August 2011. The unnamed source further notes that Mrs. Obama also enjoys “drinking expensive booze during her trips. She favors martinis with top-shelf vodka and has a taste for rich sparking wines.”

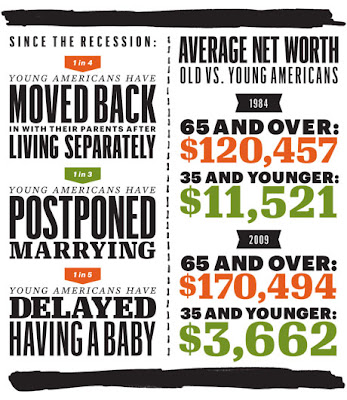

We are now approaching a $16 trillion dollar national debt, with $8 trillion of it accumulated between the time when the Democrats took over the House and Senate in January 2007 to now. You would think that we might see some awareness of the situation from the man in charge. But he seems to be oblivious to what real Americans are facing as they try to make ends meet.