Before, I wrote about India’s election results and the decision of the ruling Congress Party to drastically cut income taxes. And I also wrote about China’s decision to cut taxes on purchases of new automobiles. So did those tax cuts work out for India and China?

Story from the Associated Press

Excerpt:

China extended its lead over the U.S. as the world’s biggest auto market in November, with production and sales both surpassing 1 million vehicles, and India saw sales jump 71.9-percent.

[…]China’s auto market is sizzling, thanks largely to tax cuts and subsidies aimed at supporting the industry and encouraging use of more fuel-efficient vehicles. The boom has clinched China’s status as the world’s biggest vehicle market due to languishing sales in the U.S.

[…]The surge is also a sign of how the Indian consumer — encouraged by government tax cuts, a big disbursement of back pay for government employees and falling interest rates — is fueling economic growth in Asia’s third-largest economy.

As everyone knows, the Democrats chose to bail out auto companies with taxpayer money and reward people with taxpayer money for destroying fully functional vehicles. And we all know how well that has worked out.

Chile poised to jump from the third world to the first world

Check out this editorial from Investors Business Daily. (podcast here)

Excerpt:

Chile is expected to win entry to OECD’s club of developed countries by Dec. 15 — a great affirmation for a once-poor nation that pulled itself up by trusting markets. One thing that stands out here is free trade.

[…]It’s not like Chile was born lucky. Only 30 years ago, it was an impoverished country with per capita GDP of $1,300. Its distant geography, irresponsible neighbors and tiny population were significant obstacles to investment and growth. And its economy, dominated by labor unions, wasn’t just closed, but sealed tight.

In the Cato Institute’s 1975 Economic Freedom of the World Report it ranked a wretched 71 out of 72 countries evaluated.

Today it’s a different country altogether. Embracing markets has made it one of the most open economies in the world, ranking third on Cato’s index, just behind Hong Kong and Singapore. Per capita GDP has soared to $15,000.

Besides its embrace of free trade, other reforms — including pension privatization, tax cuts, respect for property rights and cutting of red tape helped the country grow not only richer but more democratic, says Cato Institute trade expert Daniel Griswold.

But the main thing, Griswold says, is that the country didn’t shift course. “Chile’s economy is set apart from its neighbors, because they have pursued market policies consistently over a long period,” he said. “Free trade has been a central part of Chile’s success.”

Democrats oppose free trade, and their hostility to free trade angers many other countries in the world.

What does it take for a country to succeed?

I gave my Dad my copy of “Money, Greed and God” by Jay Richards, and although he thought that it started out slow, he’s warmed up to it. He calls me on the phone at least twice a day, and last night he alerted me to this web site, where you can track each countries average citizen’s life span and per-capita GDP over time. My Dad was pretty liberal on economics before, so naturally I’ve been working on him with lots of introductory books on economics. He’s read about a dozen now, and Thomas Sowell is his favorite.

Anyway, my Dad says that this is what a country needs to succeed:

- free trade with other nations

- the rule of law

- low judicial activism

- low tax rates

- private property protections

- currency not threatened by inflation

- low government spending

- minimal regulation of commerce

And at that web site, you can track the success of countries like Singapore and Hong Kong, which embrace conservative small government free market fiscal policies, and compare them with countries like Zimbabwe and North Korea, which embrace big government protectionist fiscal policies. Countries fail because they adopt the wrong policies. They succeed when they adopt the right policies. It doesn’t matter how poor they start, if they have the right policies, they grow rich over time.

Why are the Democrats so incompetent on economic policy?

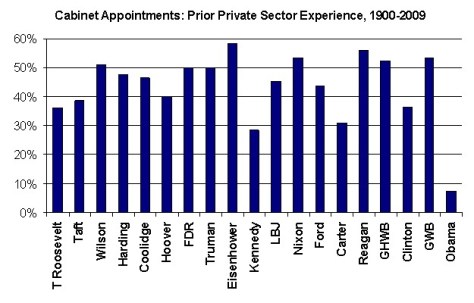

Well, it’s because there is almost no one in the Obama socialist regime who has ever run a business or worked in a business. Check out this graphic. (H/T Flopping Aces)

You can read more about the Obama administration’s ignorance of business and economics here in Forbes magazine.

This Reuters article discusses the price of economic ignorance: (H/T Gateway Pundit)

Excerpt:

Hunger is spreading while the number of homeless families is increasing as a result of the recession and other factors, according to a report on Tuesday.

The U.S. Conference of Mayors said cities reported a 26 percent jump in demand for hunger assistance over the past year, the largest average increase since 1991.

Middle-class families as well as the uninsured, elderly, working poor and homeless increasingly looked for help with hunger, which was mainly fueled by unemployment, high housing costs and low wages.

Democrats really don’t know what they are doing. It’s like putting pre-schoolers in charge of Amazon.com. It doesn’t work. Their ivory tower, silver-spoon worldview cannot comprehend real-world, grown-up complexities. So long as the Democrats continue to attack the businesses that employ citizens while redistributing wealth from people who produce to people who vote Democrat, our economic troubles will continue.

Related Cato Institute podcasts

- How to create a job (9 minutes)

- Trade, trade, please go away (6 minutes)

- The rule of law and the Fed (12 minutes)