The way Social Security taxes work is that you pay 12.4% of your salary, and another 2.9% for Medicare. That’s 15.3%, before any federal, state and local taxes. So, what are you getting for this 12.4% contribution to the Social Security welfare program? You’re supposed to be able to withdraw that money when you retire, but that money isn’t being stored in an account with your name on it. It’s being spent right now on people who are already retired. Will there be money available for you to withdraw when you retire?

If you’re a young person who retires in 2035 or later, the answer is absolutely not.

The Daily Signal has the numbers:

The American people need to know the state of finances of the Social Security program so they can better understand why reform is not only necessary, but absolutely essential. Here are five takeaways from the most recent financial report:

- $66 Billion Cash-Flow Deficit in 2016

Social Security is still considered solvent and able to pay full benefits because it has accumulated a $2.8 trillion trust fund, but since the entirety of its trust fund consists of IOUs, cash-flow deficits must be financed by general revenue taxes or new public borrowing.

Since 2010, the Old-Age and Survivors Insurance program has taken in less money from payroll tax revenues and the taxation of benefits than it pays out in benefits, generating cash-flow deficits.

- $14.3 Trillion in Unfunded Obligations

However, this figure assumes that the $2.8 trillion in trust fund reserves are available to be spent. The problem is that these reserves represent liabilities for the U.S. taxpayer. The payroll revenues have been spent and the trust fund was credited with U.S. bonds, which represent claims on the American taxpayer. This is why the actual unfunded obligation is $14.3 trillion.

The trustees report that Social Security’s unfunded obligation has reached $11.5 trillion. That is the difference between what the program is expected to receive in income and what is expected to spend over the 75-year horizon the program’s actuaries consider for projections.

- Insolvent by 2035

Based on current projections, the Social Security Old-Age and Survivors Insurance trust fund will be depleted by 2035, reducing Social Security’s expenditures automatically to what the program will receive in revenues, regardless of benefits due at that time.

Social Security is only legally permitted to spend funds in excess of its revenues until its trust fund is depleted.

- 25 Percent Automatic Benefit Cut

What this means for beneficiaries is that in the absence of congressional action, benefits could be delayed or indiscriminately reduced across the board by 25 percent.

Once the Social Security trust fund is depleted, the program will only be able to pay 75 percent of scheduled benefits, based on payroll and other Social Security tax revenues projected at that time.

- High Costs to Delaying Reform

The trustees highlight that if Congress waits until the trust funds become exhausted, the cost of making the program solvent will be as much as 40 percent higher, meaning significantly greater benefit cuts and/or tax increases for workers and beneficiaries.

There are several key reforms Congress could pursue to preserve benefits for the most vulnerable beneficiaries without increasing the tax or debt burden on younger generations. However, the longer Congress waits the act, the larger the changes that will be necessary to address Social Security’s combined financing shortfall.

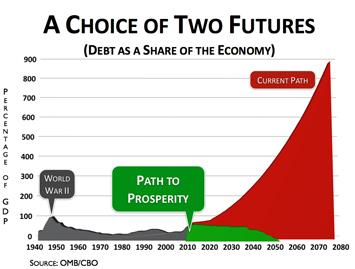

Young people working today who retire in 2035 or later will never see a dime of their Social Security contributions. What’s more likely is that the taxes on their income will go even higher. Take a good look at your paycheck, and you will see money being deducted for this entitlement program. This is money you will never see again. It is being used now, to buy the votes of elderly people who vote against reform when they vote Democrat.

The only person to try to do something about these Social Security problems was George W. Bush – a Republican. But his effort to set up private savings accounts was stopped by Democrats, who depend on the votes of the people who collect from Social Security.

These problems are even worse when you realize that Social Security is only one of the entitlement programs that is going bankrupt. There are others – as well as interest on the $20 trillion debt. ($10 trillion of which was added by Obama in his 8 years as Welfare President). Young people: you are paying taxes for programs that will not be there for you when you need them. Stop voting Democrat, because money matters!