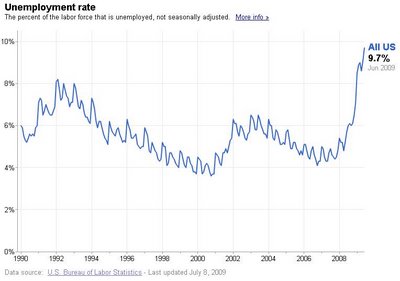

Obama’s unemployment rate is now a 9.5% and heading over 10%. About 3.5 MILLION jobs lost by the President ACORN-lawyer.

Let’s examine the numbers, and how the media reported on the numbers.

Here’s what the Washington Post said after Bush’s tax cuts lowered the unemployment rate to 5.4%:

For President Bush, tax cuts have been an all-purpose elixir, a cure for budget surpluses and a bursting stock bubble, for terrorist attacks and boardroom scandals, for the march to war and a jobless recovery in peacetime.

Now, after three successive tax cuts, and after a record budget surplus has turned to a record deficit, the president faces an unenviable choice. He can either concede that his $1.7 trillion tonic has not worked as advertised, or he can insist that the economy is strong despite the slowdown in growth and job creation.

Bush cut taxes on the most productive job-creating parts of the economy by 2.2 trillion overall in his two terms.

But what about Obama? The Post writes:

The big news of the week should be Friday’s employment report, which many analysts suspect will show that the labor market, while still quite bad, continues on a path toward stabilization. Economists are expecting the unemployment rate to rise to 9.5 percent, from 9.4 percent, and for employers to have cut 228,000 net jobs in August, compared with the 247,000 jobs lost in March. That job loss number — or even better, a figure that starts with a “1,” would be strong evidence that improvement in the economy is finally filtering through to the job market in a serious way.

But there are reasons to doubt that will happen. Most notably, the rate of new jobless claims has failed to come down significantly in recent weeks, which suggests businesses are still eager to pare back their payrolls. Thursday, the Labor Department said 570,000 Americans put in new claims for unemployment insurance benefits, down only barely from 580,000 the previous week.

Surprise! Communism is bad for the economy! Who knew?

Economics in One Lesson

We are going to have to pay for all this spending on Obama’s favored special interest groups eventually, and that means that taxes will go up, or that the value of the dollar will go down, due to inflation. It has to be one or the other or both. There is no third way.

Perhaps it is time to review Henry Hazlitt’s Economics in One Lesson, chapter 4, entitled “Public Works Mean Taxes”.

Excerpt:

Therefore, for every public job created by the bridge project a private job has been destroyed somewhere else. We can see the men employed on the bridge. We can watch them at work. The employment argument of the government spenders becomes vivid, and probably for most people convincing. But there are other things that we do not see, because, alas, they have never been permitted to come into existence. They are the jobs destroyed by the $10 million taken from the taxpayers. All that has happened, at best, is that there has been a diversion of jobs because of the project. More bridge builders; fewer automobile workers, television technicians, clothing workers, farmers.

And consider Chapter 5 as well, entitled “Taxes Discourage Production”.

In our modern world there is never the same percentage of income tax levied on everybody. The great burden of income taxes is imposed on a minor percentage of the nation’s income; and these income taxes have to be supplemented by taxes of other kinds. These taxes inevitably affect the actions and incentives of those from whom they are taken. When a corporation loses a hundred cents of every dollar it loses, and is permitted to keep only fifty-two cents of every dollar it gains, and when it cannot adequately offset its years of losses against its years of gains, its policies are affected. It does not expand its operations, or it expands only those attended with a minimum of risk. People who recognize this situation are deterred from starting new enterprises. Thus old employers do not give more employment, or not as much more as they might have; and others decide not to become employers at all. Improved machinery and better-equipped factories come into existence much more slowly than they otherwise would. The result in the long run is that consumers are prevented from getting better and cheaper products to the extent that they otherwise would, and that real wages are held down, compared with what they might have been.

There is a similar effect when personal incomes are taxed 50, 60 or 70 percent. People begin to ask themselves why they should work six, eight or nine months of the entire year for the government, and only six, four or three months for themselves and their families. If they lose the whole dollar when they lose, but can keep only a fraction of it when they win, they decide that it is foolish to take risks with their capital. In addition, the capital available for risk-taking itself shrinks enormously. It is being taxed away before it can be accumulated. In brief, capital to provide new private jobs is first prevented from coming into existence, and the part that does come into existence is then discouraged from starting new enterprises. The government spenders create the very problem of unemployment that they profess to solve.

What Obama did, in effect, is to fire all of those millions of private sector people, so that he could reward the people who voted for him. And jobs are created far more efficiently by small businesses than they are by big government. This is the science of economics.

Let’s drop the Peter-Pan politically-correct policies of the left, and elect Republicans in 2010.