In this American Spectator piece entitled “Obama the Destroyer“, Quin Hillyer recounts the many deeds that Obama performed in order to weaken America.

Hilyer writes:

If somebody were deliberately trying to undermine the very fabric of these United States, he would first vow not just to change its policies but to completely “change America,” and then would do just about everything Barack Obama already has begun to do as president.

He then lists some of the specific areas that Obama has weakened:

- contract law (which is part of the foundation of capitalism and free enterprise)

- strict interpretation of the Constitution

- counter-terrorism (released interrogation techniques)

- responsible spending and size of government

- energy production

- missile defense

- military preparedness and research

- border security

- transparency and free/open debate on legislation

- freedom of choice in health care

- the integrity of the voting/census system

- diplomacy and foreign policy

I could name at least a half-dozen more areas not on that list, such as the Western Experience’s post about Obama’s decision to weaken our nuclear capabilities. In fact, Jason has a whole article on the Obama’s naive, weak foreign policy.

But foreign policy is one thing, what about the cost of the trillions in spending? Writing in the Weekly Standard, Irwin M. Stelzer explains that there are only two ways out of the massive deficits that Obama has run up: Higher taxes, which destroys economic growth and ships jobs overseas, and hyperinflation, which impoverishes the poorest among us by making them pay more for everything.

He lists all the mistakes that the ACORN lawyer has made, and concludes:

We are also certain to see the portion of our pay that we actually get to take home decline significantly. The debt that Obama is running up will have to be repaid. Already, there are grumblings in the market about the future of the dollar, with the Chinese not the only one of our creditors worrying that we will inflate our way out of our obligations. Run the presses, make dollars cheaper, and use the debased currency to repay debts.

…But inflation is not the only possibility. Instead, politicians, remembering the fate of Jimmy Carter when he allowed inflation to climb towards 20 percent, will try to restore fiscal sanity by raising taxes. Harvard economist Martin Feldstein, who supported the president’s stimulus package, puts the needed tax increase at $1.1 trillion over the next decade; the International Monetary Fund puts the figure at $1.9 trillion, a sum the magnitude of which is better understood when written as $1,900,000,000,000.

And don’t forget the looming problem of entitlements. You remember. Social Security and Medicare? Costs ballooning out of control? Matthew Continetti writes about it in the Weekly Standard:

The trustees conclude that a combination of lavish benefits, an aging population, and a moribund economy has brought the United States’s social insurance system close to bankruptcy. Medicare is already running a deficit, and the trustees say that it will be totally out of money by 2017. Social Security will be in the red as soon as 2016. That’s a problem not only for Social Security. It’s a problem for the federal budget.

…Meanwhile, bizarrely and perversely, Obama and the Democrats on Capitol Hill say that the only way to fix America’s spending problem–we are not making this up–is to spend more money. More on energy. Health care. Education. The three pillars of the president’s “new foundation.” Don’t worry about the cost, Obama says. The rich guy at the other table will pick up the bill.

What sort of person would spend trillions of dollars in a recession with a looming entitlement crisis? Oh, I know. An unqualified spendthrift who can’t even keep his own financial house in order.

Gateway Pundit reminds us that the Democrats understand that their cap and trade bill with hurt the poorest people the most. And they don’t care! Most of them are probably like Al Gore, who owns assets that will benefit from the unnecessary government regulations.

Gateway Pundit writes at the American Issues Project:

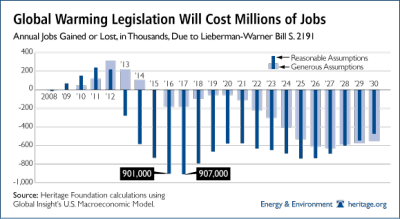

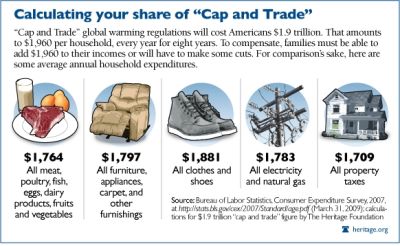

The potential cost of the democrat’s cap and trade policy is enormous. It will likely cost $700 to $1,400 dollars per family per year. The Department of Energy estimated that a similar bill, S. 2191, the Warner-Lieberman cap-and-trade proposal, will increase the cost of coal for power generation by between 161 percent and 413 percent. Human Events reported that the DOE estimated GDP losses (see chart) over the 21-year period they forecast, at between $444 billion and $1.308 trillion. There are estimates that the bill could increase unemployment by 2.7 percent or about 4 million jobs.

White House Budget Director Peter Orszag was on “This Week” with George Stephanopoulos in March. During his interview Orszag admitted that Obama’s proposed cap and trade energy legislation will increase energy costs for everyone. The Heritage Foundation reported that cumulative GDP losses for 2010 to 2029 approach $7 trillion. Single-year losses exceed $600 billion in 2029, more than $5,000 per household. Job losses are expected to exceed 800,000 in some years, and exceed at least 500,000 from 2015 through 2026. In Missouri and the Midwest where energy is “cheap” the democrat’s legislation would cause electricity rates to double. Even the far left Huffington Post admits that the approach taken by the Waxman-Markey bill does not alleviate the problem whereby household consumers will pay higher energy costs.

The article continues here.

Remember when Obama said this in 2008?

“Under my plan of a cap and trade system electricity rates would necessarily skyrocket. Businesses would have to retrofit their operations. That will cost money. They will pass that cost onto consumers.”

What? You voted for Obama and the MSM didn’t tell you that he said that? I’m shocked.