These days, everyone seems to think that being good to the poor means looking around to see what people are saying is good to the poor, then loudly shouting your agreement with it. People want to look good to others more than they want to help others. Besides, looking good by loud virtue signaling is free. If we really wanted to help people, though, we should tell them to do what will work.

So let’s talk about poverty in America, with help from famous black economist Walter Williams.

First, he says real poverty is not common in America:

There is no material poverty in the U.S. Here are a few facts about people whom the Census Bureau labels as poor. Dr. Robert Rector and Rachel Sheffield, in their study “Understanding Poverty in the United States: Surprising Facts About America’s Poor”, report that 80 percent of poor households have air conditioning; nearly three-quarters have a car or truck, and 31 percent have two or more. Two-thirds have cable or satellite TV. Half have one or more computers. Forty-two percent own their homes. Poor Americans have more living space than the typical non-poor person in Sweden, France or the U.K. What we have in our nation are dependency and poverty of the spirit, with people making unwise choices and leading pathological lives aided and abetted by the welfare state.

Second, the “poverty” is not caused by racism, but by poor choices:

The Census Bureau pegs the poverty rate among blacks at 35 percent and among whites at 13 percent. The illegitimacy rate among blacks is 72 percent, and among whites it’s 30 percent. A statistic that one doesn’t hear much about is that the poverty rate among black married families has been in the single digits for more than two decades, currently at 8 percent. For married white families, it’s 5 percent. Now the politically incorrect questions: Whose fault is it to have children without the benefit of marriage and risk a life of dependency? Do people have free will, or are they governed by instincts?

There may be some pinhead sociologists who blame the weak black family structure on racial discrimination. But why was the black illegitimacy rate only 14 percent in 1940, and why, as Dr. Thomas Sowell reports, do we find that census data “going back a hundred years, when blacks were just one generation out of slavery … showed that a slightly higher percentage of black adults had married than white adults. This fact remained true in every census from 1890 to 1940”? Is anyone willing to advance the argument that the reason the illegitimacy rate among blacks was lower and marriage rates higher in earlier periods was there was less racial discrimination and greater opportunity?

Third, avoiding poverty is the result of good choices:

No one can blame a person if he starts out in life poor, because how one starts out is not his fault.

If he stays poor, he is to blame because it is his fault. Avoiding long-term poverty is not rocket science. First, graduate from high school. Second, get married before you have children, and stay married. Third, work at any kind of job, even one that starts out paying the minimum wage. And finally, avoid engaging in criminal behavior. It turns out that a married couple, each earning the minimum wage, would earn an annual combined income of $30,000. The Census Bureau poverty line for a family of two is $15,500, and for a family of four, it’s $23,000. By the way, no adult who starts out earning the minimum wage does so for very long.

Fourth, what stops people from making good choices is big government:

Since President Lyndon Johnson declared war on poverty, the nation has spent about $18 trillion at the federal, state and local levels of government on programs justified by the “need” to deal with some aspect of poverty. In a column of mine in 1995, I pointed out that at that time, the nation had spent $5.4 trillion on the War on Poverty, and with that princely sum, “you could purchase every U.S. factory, all manufacturing equipment, and every office building. With what’s left over, one could buy every airline, trucking company and our commercial maritime fleet. If you’re still in the shopping mood, you could also buy every television, radio and power company, plus every retail and wholesale store in the entire nation”. Today’s total of $18 trillion spent on poverty means you could purchase everything produced in our country each year and then some.

Regarding those last two points, here is another famous black economist, Thomas Sowell:

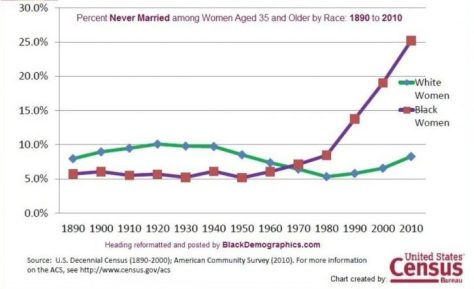

To illustrate this point, here’s a graph with some helpful data taken from the U. S. Census.

In fact, there is a whole video featuring Thomas Sowell to go with this graph:

And an article to go with it:

If we wanted to be serious about evidence, we might compare where blacks stood a hundred years after the end of slavery with where they stood after 30 years of the liberal welfare state. In other words, we could compare hard evidence on “the legacy of slavery” with hard evidence on the legacy of liberals.

Despite the grand myth that black economic progress began or accelerated with the passage of the civil rights laws and “war on poverty” programs of the 1960s, the cold fact is that the poverty rate among blacks fell from 87 percent in 1940 to 47 percent by 1960. This was before any of those programs began.

Over the next 20 years, the poverty rate among blacks fell another 18 percentage points, compared to the 40-point drop in the previous 20 years. This was the continuation of a previous economic trend, at a slower rate of progress, not the economic grand deliverance proclaimed by liberals and self-serving black “leaders.”

Ending the Jim Crow laws was a landmark achievement. But, despite the great proliferation of black political and other “leaders” that resulted from the laws and policies of the 1960s, nothing comparable happened economically. And there were serious retrogressions socially.

Nearly a hundred years of the supposed “legacy of slavery” found most black children being raised in two-parent families in 1960. But thirty years after the liberal welfare state found the great majority of black children being raised by a single parent.

The rest of the article points out how even crime rates among blacks were caused by the implementation of soft law enforcement policies by progressives. Just look at the big cities if you want to know what it is like for blacks to be ruled by Democrats. It sucks!

If everybody started to read more Thomas Sowell books, we would be much better off as a country! Only good things happen when people stop watching TV and listening to music and watching movies, and instead settle down in a chair with a Thomas Sowell book. I recommended a bunch of them in a previous post.