Last night, I watched the Democrat debate, and I saw a bunch of people “solve” all of the worlds problems with their hand-waving and happy-talk. Almost no evidence for the effectiveness of any policy was offered, and rarely did anyone pointed to numbers showing that their past actions had succeeded.

At one point, the King of the Clowns Bernie Sanders pointed to Denmark as proof that his socialist ideas would all work.

So I thought we might take a quick look at see how socialism is doing in Denmark, and in Europe more generally.

This is from the government-run news media in Canada, the CBC.

They write:

More than a quarter of Japan’s citizens are at least 65, making it the world’s fastest aging country. In Canada, about 16.1 per cent of us are seniors.

Right now in Japan, there’s a higher demand for adult diapers than children’s diapers, economist Michael Moffatt says, a “stunning statistic” that illustrates one of the main reasons why the country’s economy has been treading water for the better part of two decades.

“They haven’t been able to find a way to get their economy to grow in a significant way while still being able to support an older population,” the Richard Ivey School of Business professor said.

Japan’s GDP has grown at an average rate of 1.3 per cent for the past 25 years, according to the World Bank, dropping from averages of more than five per cent annual growth in earlier decades.

Yes, that’s because Japan’s solution to economic growth has been the Democrat solution: stimulus spending, massive borrowing, low (and decreasing) interest rates. It’s Obamanomics, and guess what? It doesn’t work there, either.

More:

Sweden and Denmark are the “places we need to turn to,” Foot said, in crafting economic and health policy to manage the shift in demographics. While the countries take different approaches, they all focus on health care, offering programs akin to pharmacare or following up with seniors in their homes after a visit to the hospital.

And while Sweden’s residents are not collectively older than Japan’s, about a quarter of the country’s 9.5 million residents are at least 60, according to Global Age Watch.

The public purse covers most home-care and long-term care in both Sweden and Denmark.

Unsurprisingly, they are among the highest taxed countries in the European Union, according to Eurostat. In 2013, Sweden topped the list, while in 2014 it was Denmark.

Policy-makers in Canada will have to make similar choices when it comes to taxes, Foot said, arguing more tax revenue will be needed, although there may be alternative ways of collecting it.

Foot said Ottawa and the provinces could look at taxing different sources, like foreign exchange or stock market transactions.

“If the state or government doesn’t step in, we’ll see poverty rise amongst our senior population,” he said. “We’ll go back to the days when poverty rates in that population were upwards of 30 per cent.”

So, massive government intervention in the free market in the areas of health care has not actually helped them, it has hurt them. And what happens to marriage rates and birth rates when you take 50-70% of a man’s salary? Does it make him start a business and hire other people? Does it make him want to marry? Does it make him want to have children? Are men happy when their wives are forced to work, and when their children are taught by public school teachers and monitored by government social workers? Do men like it when they pay taxes to other people to decide what their family will amount to and what their children will believe? Big government has a corrupting influence on character, turning people away from marriage, family and work.

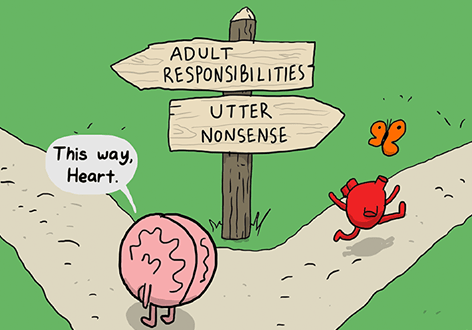

The Democrat candidates in the debate want to turn us into Greece. They assume (somewhat naively) that all other behaviors will remain constant as they ramp up government spending and then borrow and tax to pay for it. But anyone who thinks about the problem for more than 5 seconds can see that businesses and individuals do not keep on doing what they were doing when spending and taxes increase. To be a Democrat is to not understand basic economics. It is to persist in childhood, having tantrums, ignoring how incentives change for everyone who is affected by childish policies.

Maybe the CBC is too conservative… let’s go to the BBC, they are hard leftists. What does the BBC say?

They say this:

As German Chancellor Angela Merkel is fond of repeating, the EU accounts for just 7% of the world’s population and a quarter of its gross domestic product (GDP) but as much as half of its welfare spending.

[…]Social expenditure per person in the EU in 2012 (the most recent year available, using a harmonised definition) was €7,600 (£5,540), but with a range from €18,900 (£13,800) in Luxembourg to just €927 (£675) in Bulgaria. The UK figure was €8,700 (£6,340).

Interestingly, average EU spending per citizen is almost the same as in the United States and well below that in Switzerland, after adjusting for price differences. Typically, poverty relief, health and pensions are much the biggest components of welfare spending, whereas unemployment benefits cost relatively less.

Sounds like a Democrat paradise, right? This is the Holy Grail to socialists like Bernie Sanders and Hillary Clinton.

More:

Over the past 15 years, the average fertility rate (children per woman) in the EU has been 1.54, ranging from barely over 1.3 in Hungary and Spain, and 1.36 in Germany, to 1.8 in the UK and just under two in Ireland, France and Sweden.

According to the “main scenario” of the latest Eurostat population projections, Germany’s population has already started to shrink and is expected to fall from 82 million in 2013 to 74 million by 2050.

Well, wait now. Democrats told me that if we just nationalize everything that the private sector does, and raise tax rates on job creators and investors, and make all the women get out of their homes and work like men, and criminalize homeschooling, and marginalize Christianity, and abort the next generation of workers, and pay single mothers welfare to raise future criminals, and enact no-fault divorce to get men out of the homes, and teach children to have premarital sex at age 12 so that men get sex without having to marry first, then men and women would just be as interested in starting businesses, working hard, getting married and parenting as they were before? Are you telling me that letting the government control everything, and taking most of what people earn to pay for it, actually discourages people from starting businesses, working, marrying and having kids? Who is going to pay for all these expensive social programs, then?

And this is what Democrats hold up as perfection – heaven on Earth. Instead of closing their eyes to reality and wishing we were Europe, why don’t they actually look at Europe first? And maybe take a first-year course in economics.