This is from CBS News. (H/T Robert Stacy McCain)

Excerpt:

Social Security’s finances are getting worse as the economy struggles to recover and millions of baby boomers stand at the brink of retirement.

New congressional projections show Social Security running deficits every year until its trust funds are eventually drained in about 2037.

This year alone, Social Security is projected to collect $45 billion less in payroll taxes than it pays out in retirement, disability and survivor benefits, the nonpartisan Congressional Budget Office said Wednesday. That figure swells to $130 billion when a new one-year cut in payroll taxes is included, though Congress has promised to repay any lost revenue from the tax cut.

The massive retirement program has been feeling the effects of a struggling economy for several years. The program first went into deficit last year, but the CBO said at the time that Social Security would post surpluses for a few more years before permanently slipping into deficits in 2016.

The outlook, however, has grown bleaker as the nation struggles to recover from the worst economic crisis since Social Security was enacted during the Great Depression. In the short term, Social Security is suffering from a weak economy that has payroll taxes lagging and applications for benefits rising. In the long term, Social Security will be strained by the growing number of baby boomers retiring and applying for benefits.

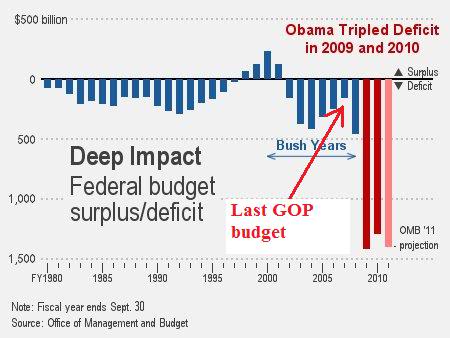

The deficits add a sense of urgency to efforts to improve Social Security’s finances. For much of the past 30 years, Social Security has run big surpluses, which the government has borrowed to spend on other programs. Now that Social Security is running deficits, the federal government will have to find money elsewhere to help pay for retirement, disability and survivor benefits.

You may remember that George W. Bush tried to reform Social Security during his Presidency, but left-wing media and the Democrats cowed him into submission. Shut up, they explained. Just like they shut him up on his plan to regulate Fannie Mae and Freddie Mac back in 2003.

Here’s why nothing is going to be done to fix the problem. (H/T Hyscience)

It’s not going to be fixed until we vote out every last Democrat and replace them with grown-ups from the grown-up party.