Is he right? Here’s the Wall Street Journal.

Excerpt:

Mr. Obama asserted in his January State of the Union Address that by the time he took office, “we had a one-year deficit of over $1 trillion and projected deficits of $8 trillion over the next decade. Most of this was the result of not paying for two wars, two tax cuts, and an expensive prescription drug program.”

In short, it’s all President Bush’s fault. But Mr. Obama’s assertion fails on three grounds.

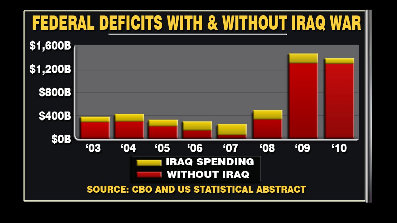

First, the wars, tax cuts and the prescription drug program were implemented in the early 2000s, yet by 2007 the deficit stood at only $161 billion. How could these stable policies have suddenly caused trillion-dollar deficits beginning in 2009? (Obviously what happened was collapsing revenues from the recession along with stimulus spending.)

Second, the president’s $8 trillion figure minimizes the problem. Recent CBO data indicate a 10-year baseline deficit closer to $13 trillion if Washington maintains today’s tax-and-spend policies—whereby discretionary spending grows with the economy, war spending winds down, ObamaCare is implemented, and Congress extends all the Bush tax cuts, the Alternative Minimum Tax (AMT) patch, and the Medicare “doc fix” (i.e., no reimbursement cuts).

Under this realistic baseline, the 10-year cost of extending the Bush tax cuts ($3.2 trillion), the Medicare drug entitlement ($1 trillion), and Iraq and Afghanistan spending ($515 billion) add up to $4.7 trillion. That’s approximately one-third of the $13 trillion in baseline deficits—far from the majority the president claims.

Third and most importantly, the White House methodology is arbitrary. With Washington set to tax $33 trillion and spend $46 trillion over the next decade, how does one determine which policies “caused” the $13 trillion deficit? Mr. Obama could have just as easily singled out Social Security ($9.2 trillion over 10 years), antipoverty programs ($7 trillion), other Medicare spending ($5.4 trillion), net interest on the debt ($6.1 trillion), or nondefense discretionary spending ($7.5 trillion).

There’s no legitimate reason to single out the $4.7 trillion in tax cuts, war funding and the Medicare drug entitlement. A better methodology would focus on which programs are expanding and pushing the next decade’s deficit up.

The article notes that the real problem is that Obama is spending money like he has gone mad.

Spending—which has averaged 20.3% of GDP over the past 50 years—won’t remain as stable [as revenue]. Using the budget baseline deficit of $13 trillion for the next decade as described above, CBO figures show spending surging to a peacetime record 26.5% of GDP by 2020 and also rising steeply thereafter.

Putting this together, the budget deficit, historically 2.3% of GDP, is projected to leap to 8.3% of GDP by 2020 under current policies. This will result from Washington taxing at 0.2% of GDP above the historical average but spending 6.2% above its historical average.

Entitlements and other obligations are driving the deficits. Specifically, Social Security, Medicare, Medicaid and net interest costs are projected to rise by 5.4% of GDP between 2008 and 2020. The Bush tax cuts are a convenient scapegoat for past and future budget woes. But it is the dramatic upward arc of federal spending that is the root of the problem.

Spending is the problem, and Obama is spending like a drunken sailor.

In fact, he added more to the debt in his first 19 months than ALL the other 19 Presidents COMBINED!

And remember, the recession is almost entirely the fault of the Democrats. You can watch videos of them telling the Republicans not to regulate Fannie Mae and Freddie Mac to stop them from making mortgage loans to people who cannot afford them. The only other factor is the decision to keep interest rates low to encourage more and more borrowing – the “boom” in spending that necessarily leads to a “bust”.