Jennifer Rubin over at Pajamas Media writes that the GOP has had enough with the Democrats’ big-spending socialist agenda, and they are ready to try something completely different: small government conservatism. Instead of just being the party of “NO”, the GOP intends to market a series of common sense conservative policies directly to Americans.

Rubin writes:

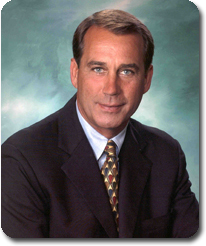

Minority Leader John Boehner has a new video out listing a number of Republican themes and promising a Republican alternative budget from reformer Rep. Paul Ryan. The themes are simple: lower taxes, restrain the growth of government, a market-based health care plan, domestic energy development, and ending bailout mania. Boehner’s video does not have many details, but its core message is clear: Republicans are tired of being the punching bag for an administration that wishes to paint itself as the only source of ideas capable of solving the country’s problems.

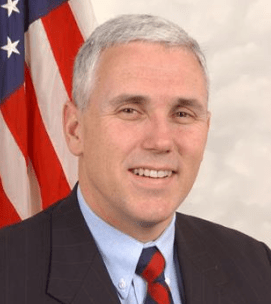

But I didn’t like John Boehner’s video as much as this one from Rep. Paul Ryan:

He can make the case in the House of Representatives:

And look, he can take on the leftist news media, too:

Fun! Rubin continues with some links to wonderful policy ideas:

Truth be told, for months, Republicans inside and outside of government have been throwing out ideas on how to revive the economy. Americans for Tax Reform has ten ideas to help small business. Newt Gingrich has twelve ideas to promote job growth and recovery. And budget draftsman Paul Ryan has had “A Road Map for America’s Future” for some time. But the mainstream media is uninterested in reading through all of this, much of the conservative blogosphere is too invested in carping about the shortcomings of elected leaders and in fighting among themselves, and the president, of course, has made a habit of disparaging his opposition’s lack of creative ideas.

…the task here is to capture the public’s dissatisfaction with the Democrats’ bailout and pork-laden approach to governance and remind voters that Republicans in fact do have ideas — ones that favor lower taxes and less spending.

As soon as I read this, I rushed over to the Cato Institute to see their take on Ryan’s plan, and I found an article by Michael D. Tanner.

Health Care: Ryan would reform our employment-based insurance system by replacing the current tax exclusion for employer-provided insurance with a refundable tax credit of $2,500 for individuals, and $5,000 for families. This would encourage employers to take the money they currently spend providing health insurance and give it directly to workers, who could then use it to purchase competitive, personally owned insurance plans. That would be insurance that met their needs, not those of their bosses, and people wouldn’t lose it if they lost their jobs.

Ryan would also allow workers to shop for insurance across state lines. That would mean residents of states like New Jersey and New York, where regulation has made insurance too expensive for many people, could buy their insurance in states where it cost less. And increased competition would help bring insurance costs down for all of us.

Since I am a clean-living, never-married single guy, this would basically add a bunch of money to my take home pay. More money for donations to Reasonable Faith and the Discovery Institute! So far so good!

Tanner continues:

Social Security: Like Medicare, Social Security is hurtling toward insolvency. Rep. Ryan would preserve the program unchanged for current recipients and workers older than age 55, but he would allow younger workers to invest part of their Social Security taxes privately through personal accounts. Unlike the present system, workers would own the funds in their accounts, and when they died, they could pass any remaining funds on to their heirs.

Taxes: Rep. Ryan would radically simplify today’s hopelessly complex, cumbersome and bureaucratic tax code. He would give filers a choice: They could pay their taxes under existing law, or they could choose a new simplified code, with just two tax rates (10 percent on the first $100,000 for joint filers; $50,000 for individuals, and 25 percent above that).

Human Events has some more details on the tax policy:

The tax reform aspect of the bill is appealing, offering a simplified tax system that has only two rates and eliminates the alternative minimum tax (AMT) and the death tax. The bill also abolishes taxes on interest, capital gains and dividends among other aggressive tactics that will make a noticeable, long term change.

And this interesting quotation from Ryan:

“Our fate is not inevitable…we can change it,” he said. “I want to be the Paul Revere of fiscal policy in this country.”

Now, that two-tier tax plan was one of the reasons why I preferred for Fred Thompson in the primaries… but the rest of my party wanted style, instead of substance. You blithering toadies! Who cares how warm his belly is? He opposes taxes and abortion, you hamster-brains! Oh, well. There’s always 2012, where we can try to run Mark Sanford, Bobby Jindal or maybe even Michele Bachmann!

For more on Ryan’s plan, here is an article in the Wall Street Journaltat he wrote. (H/T Western Standard Shotgun Blog)