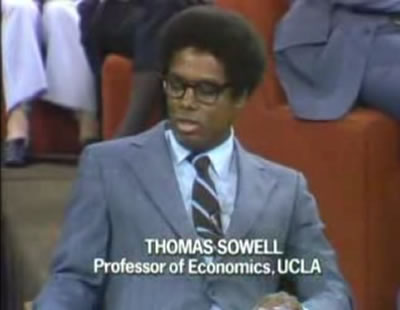

From Real Clear Politics. (H/T Jojo)

Excerpt:

One of the things that makes it tough to figure out how much has to be charged for insurance is that people behave differently when they are insured from the way they behave when they are not insured.

In other words, if one person out of 10,000 has his car set on fire, and it costs an average of $10,000 to restore the car to its previous condition, then it might seem as if charging one dollar to all 10,000 people would be enough to cover the cost of paying $10,000 to the one person whose car that will need to be repaired. But the joker in this deal is that people whose cars are insured may not be as cautious as other people are about what kinds of neighborhoods they park their car in.

[…]Although “moral hazard” is an insurance term, it applies to other government policies besides insurance. International studies show that people in countries with more generous and long-lasting unemployment compensation spend less time looking for jobs. In the United States, where unemployment compensation is less generous than in Western Europe, unemployed Americans spend more hours looking for work than do unemployed Europeans in countries with more generous unemployment compensation.

People change their behavior in other ways when the government pays with the taxpayers’ money. After welfare became more readily available in the 1960s, unwed motherhood skyrocketed. The country is still paying the price for that– of which the money is the least of it. Children raised by single mothers on welfare have far higher rates of crime, welfare and other social pathology.

San Francisco has been one of the most generous cities in the country when it comes to subsidizing the homeless. Should we be surprised that homelessness is a big problem in San Francisco?

[…]We also hear a lot of talk about “the uninsured,” for whose benefit we are to drastically change the whole medical-care system. But income data show that many of those uninsured people have incomes from which they could easily afford insurance. But they can live it up instead, because the government has mandated that hospital emergency rooms treat everyone.

And here’s another Tom Sowell column making a related point.

Excerpt:

Much has been made of the fact that families making less than $250,000 a year will not see their taxes raised. Of course they won’t see it, because what they see could affect how they vote.

But when huge tax increases are put on electric utility companies, the public will see their electricity bills go up. When huge taxes are put on other businesses as well, they will see the prices of the things those businesses sell go up.

If you are not in that “rich” category, you will not see your own taxes go up. But you will be paying someone else’s higher taxes, unless of course you can do without electricity and other products of heavily taxed businesses. If you don’t see this, so much the better for the Obama administration politically.

This country has been changed in a more profound way by corrupting its fundamental values. The Obama administration has begun bribing people with the promise of getting their medical care and other benefits paid for by other people, so long as those other people can be called “the rich.” Incidentally, most of those who are called “the rich” are nowhere close to being rich.

[…]There was a time when most Americans would have resented the suggestion that they wanted someone else to pay their bills. But now, envy and resentment have been cultivated to the point where even people who contribute nothing to society feel that they have a right to a “fair share” of what others have produced.

The most dangerous corruption is a corruption of a nation’s soul. That is what this administration is doing.

Republicans prefer private voluntary charity as the best way to provide a safety net. Just because people on the left give less to charity than people on the right, it doesn’t mean that no one one gives to charity. Europe has the highest taxes, and they give the least in charity. Why not LOWER taxes for people who want to give MORE in charity? When government hands out money, it encourages people to be more dependent. But when a person in trouble has to go to a neighbor or a charity in their own community, it sends the right message – “this should be temporary – don’t let this become a habit”. It’s not GOOD for someone to depend on the government. People need to work in order to be happy.

Having the government take over the role of provider in the home is an insult to men. It’s not government’s job to replace men. They ought to stay right out of it. Leave money in the pockets of the working man so he can save for a rainy day himself. If you subsidize a behavior, you get more of it. If you tax a behavior, you get less of it. It makes no sense to subsidize irresponsible lifestyle choices and tax productive and moral lifestyle choices. You don’t want to make the rescue from bad decisions an anonymous and automatic affair. You want people to worry, so that they won’t want to make risky and irresponsible choices. Everybody goes through though times, but we shouldn’t make it normal. People ought to know that it’s not normal.

You may want to read about how government dependence makes people less happy than having a job. Don’t make people depend on government by taxing businesses and investment. We need more companies hiring – not less. And that means letting the profit motive provide an incentive for entrepreneurs to engage in more risk-taking and enterprise.