CNS News reports.

Excerpt:

The amount of money the federal government takes out of the U.S. economy in taxes will increase by more than 30 percent between 2012 and 2014, according to the Budget and Economic Outlook published today by the CBO.

At the same time, according to CBO, the economy will remain sluggish, partly because of higher taxes.

“In particular, between 2012 and 2014, revenues in CBO’s baseline shoot up by more than 30 percent,” said CBO, “mostly because of the recent or scheduled expirations of tax provisions, such as those that lower income tax rates and limit the reach of the alternative minimum tax (AMT), and the imposition of new taxes, fees, and penalties that are scheduled to go into effect.”

The U.S. economy, CBO projects, will perform “below its potential” for another six years and unemployment will remain above 7 percent for another three.

Fox News reports that the deficit will remain above 1 trillion dollars.

Excerpt:

A new budget report released Tuesday predicts the U.S. government will run a $1.1 trillion deficit in the fiscal year that ends in September, the fourth year in a row over $1 trillion, though a slight dip from last year.

[…]The report is yet another reminder of the perilous fiscal situation the government is in, but it is commonly assumed that President Barack Obama and lawmakers in Congress that little will be accomplished on the deficit issue during an election year.

[…]”Four straight years of trillion-dollar deficits, no credible plan to lift the crushing burden of debt,” said House Budget Committee Chairman Paul Ryan, a Republican. “The president and his party’s leaders have fallen short in their duty to tackle our generation’s most pressing fiscal and economic challenges.”

“We will not solve this problem unless both sides, Democrats and Republicans, are willing to move off their fixed positions and find common ground,” said Senate Budget Committee Chairman Kent Conrad, a Democrat. “Republicans must be willing to put [tax increases] on the table.”

The study also predicts modest economic growth of 2 percent this year and forecasts that the unemployment rate will remain above 8 percent this year and next. That is based on an assumption that President Barack Obama will fail to win renewal of payroll tax cuts and jobless benefits by the end of next month.

That jobless rate is higher than the rates that contributed to losses by Presidents Jimmy Carter (7.5 percent) and George H.W. Bush (7.4 percent). The study predicts unemployment to remain above roughly 5 percent — until 2016. The agency also predicts that unemployment will remain at 7 percent or above through 2015

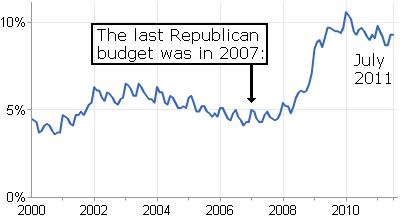

Deficits in 2007 under George W. Bush were $160 billion and the unemployment rate was around 4-5%.

The CBO report also shows that the real unemployment rate is 10%.