From Cleveland.com, a horrifying tale of liberal hypocrisy in one of the bluest cities in the country. (H/T Doug Ross @ Journal)

Excerpt:

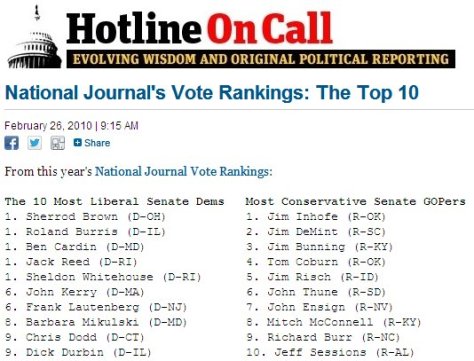

Ohio Democratic U.S. Sen. Sherrod Brown was more than four months delinquent in paying taxes on his Washington, D.C., apartment and had to pay a penalty and interest last week.

This was not the first time, records show.

Brown also was delinquent in 2006 and 2007 and paid penalties and interest, according to tax records from the District of Columbia.

“I was late,” he said on a conference call with reporters when asked about the recent delinquency. “I misplaced the bill and I paid it as soon as I found out. I paid a penalty for being late, and it won’t happen again.”

When a reporter noted that it also happened five and six years ago, Brown said: “I misplaced it then. This is a small apartment. I’m not in D.C. nearly every week, I’m here when the Senate’s in session, I’m here three or four nights a week.

Actually, a lot of Democrats get into trouble for not paying their taxes:

A new report just out from the Internal Revenue Service reveals that 36 of President Obama’s executive office staff owe the country $833,970 in back taxes. These people working for Mr. Fair Share apparently haven’t paid any share, let alone their fair share.

Previous reports have shown how well-paid Obama’s White House staff is, with 457 aides pulling down more than $37 million last year. That’s up seven workers and nearly $4 million from the Bush administration’s last year.

Nearly one-third of Obama’s aides make more than $100,000 with 21 being paid the top White House salary of $172,200, each.

The IRS’ 2010 delinquent tax revelations come as part of a required annual agency report on federal employees’ tax compliance. Turns out, an awful lot of folks being paid by taxpayers are not paying their own income taxes.

The report finds that thousands of federal employees owe the country more than $3.4 billion in back taxes. That’s up 3% in the past year.

That scale of delinquency could annoy voters, hard-pressed by their own costs, fears and stubbornly high unemployment despite Joe Biden’s many promises.

The tax offenders include employees of the U.S. Senate who help write the laws imposed on everyone else. They owe $2.1 million. Workers in the House of Representatives owe $8.5 million, Department of Education employees owe $4.3 million and over at Homeland Security, 4,697 workers owe about $37 million. Active duty military members owe more than $100 million.

The Treasury Department, where Obama nominee Tim Geithner had to pay up $42,000 in his own back taxes before being confirmed as secretary, has 1,181 other employees with delinquent taxes totaling $9.3 million.

As usual, the Postal Service, with more than 600,000 workers, has the most offenders (25,640), who also owe the most — almost $270 million. Veterans Affairs has 11,659 workers owing the IRS $151 million while the Energy Department that was so quick to dish out more than $500 million to the Solyndra folks has 322 employees owing $5 million.

The country’s chief law enforcement agency, the Department of Justice, has 2,069 employees who are nearly $17 million behind in taxes.

Even Warren Buffet’s company is in a dispute with the IRS over unpaid taxes:

Two weeks ago, when billionaire Warren Buffett called for higher taxes on rich people like him, the liberal media predictably gushed and fawned.

Yet when Americans for Limited Government revealed last week that Buffett’s company Berkshire Hathaway has been in an almost decade-long dispute with the IRS over how much taxes it owes, these same press members couldn’t care less:

According to Berkshire Hathaway’s own annual report — see Note 15 on pp. 54-56 — the company has been in a years-long dispute over its federal tax bills.

According to the report, “We anticipate that we will resolve all adjustments proposed by the U.S. Internal Revenue Service (‘IRS’) for the 2002 through 2004 tax years at the IRS Appeals Division within the next 12 months. The IRS has completed its examination of our consolidated U.S. federal income tax returns for the 2005 and 2006 tax years and the proposed adjustments are currently being reviewed by the IRS Appeals Division process. The IRS is currently auditing our consolidated U.S. federal income tax returns for the 2007 through 2009 tax years.”

Americans for Limited Government researcher Richard McCarty, who was alerted to the controversy by a federal government lawyer, said, “The company has been short-changing the tax collection agency for much of the past decade. Mr. Buffett’s company has not fully settled its tax bills from 2002-2009. Yet he says he’d happily pay more. Except the IRS has apparently been asking him to pay more going on nine years.”

I wrote an entire post about hypocrisy on the left. It’s worth a read so that you know what to make about the “compassion” rhetoric of the left.