Video stolen from NW War College.

Can the government create jobs by spending money and running deficits? (H/T Kelly)

Excerpt:

The number of Americans filing for jobless aid rose to an eight-month high last week and productivity growth slowed in the first quarter, clouding the outlook for an economy that is struggling to gain speed.

While the surprise jump in initial claims for unemployment benefits was blamed on factors ranging from spring break layoffs to the introduction of an emergency benefits program, economists said it corroborated reports this week indicating a loss of momentum in job creation.

New claims for state jobless benefits rose 43,000 to 474,000, the highest since mid-August, the Labor Department said on Thursday. Economists had expected claims to fall.

[…]Other reports this week showed weaker employment growth in the manufacturing and services sectors in April and a step back in private hiring, suggesting Friday’s closely watched data could prove weaker than economists have been expecting.

An industry survey released on Thursday found hiring by U.S. small businesses almost ground to a halt in April.

This isn’t surprising. Government spending takes money OUT of the private sector and puts money IN to the non-productive public sector.

The Heritage Foundation explains how government spending has never worked to create jobs. Not even when Republicans do it.

Excerpt:

Indeed, President Obama’s stimulus bill failed by its own standards. In a January 2009 report, White House economists predicted that the stimulus bill would create (not merely save) 3.3 million net jobs by 2010. Since then, 3.5 million more net jobs have been lost, pushing the unemployment rate above 10 percent.[1] The fact that government failed to spend its way to prosperity is not an isolated incident:

- During the 1930s, New Deal lawmakers doubled federal spending–yet unemployment remained above 20 percent until World War II.

- Japan responded to a 1990 recession by passing 10 stimulus spending bills over 8 years (building the largest national debt in the industrialized world)–yet its economy remained stagnant.

- In 2001, President Bush responded to a recession by “injecting” tax rebates into the economy. The economy did not respond until two years later, when tax rate reductions were implemented.

- In 2008, President Bush tried to head off the current recession with another round of tax rebates. The recession continued to worsen.

- Now, the most recent $787 billion stimulus bill was intended to keep the unemployment rate from exceeding 8 percent. In November, it topped 10 percent.[2]

So obviously government spending reduces employment – it could never happen any other way. And everyone who has ever held a job in private industry knows this. Government spending only works in the university classrooms, where the right answer is always the answer that makes academic wordsmiths feel good about themselves. Good intentions are the right answer in the classroom – good results are the right answer in the free market.

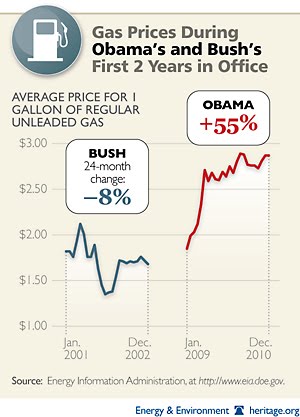

Drilling moratorium = higher gas prices = low consumer confidence

What happens to consumer confidence when Obama cuts off oil drilling and gas prices go up?

Excerpt:

Consumer confidence dropped last week to the lowest level in more than a month as rising fuel costs squeezed American household budgets.

The Bloomberg Consumer Comfort Index decreased to minus 46.2 in the week ended May 1, the lowest level since the end of March, from minus 45.1 the prior period. Another report showed claims for unemployment benefits unexpectedly surged last week, raising the risk the improvement in the jobs market has stalled.

Stocks dropped and Treasury securities rose on concern that rising expenses, including the highest gasoline prices in almost three years, may prompt companies and households to cut back on spending. The reports bolster the arguments of Federal Reserve policy makers like Chairman Ben S. Bernanke who’ve said job growth is too slow to remove record monetary stimulus.

Obama has been printing money in order to goose people into spending more instead of saving. The problem with devaluing the currency, which is what he is doing, occurs when you reach the stage where consumers stop spending because prices must increase when you print money. We are now at that stage, and our economy is about to go down the drain. Interest rates will have to rise, which is going to slow economic growth even more. This is all known.

When you don’t understand economics, you take the whack-a-mole approach to fixing the economy. That’s what Obama has done. He keeps trying to control things from the top instead of trusting businesses and consumers with their own money. Everything Obama does makes the economy worst. He doesn’t know what he is doing, and he won’t listen to people who do know. His baseless confidence (arrogance) should have been a red flag to the American people. There is nothing worse than hiring someone who thinks that they know everything, but who hasn’t the qualifications to run a lemonade stand.