The Hill reports that some Democrats want to waste even more money on “stimulus” wealth redistribution. (H/T Marathon Pundit)

Excerpt:

Senior Senate Democrats are growing frustrated by what they see as President Obama’s passivity on the economy, and are beginning to discuss a large infrastructure package funded by tax increases.

Some Democrats, such as Iowa Sen. Tom Harkin, who serves as chairman of the Health, Education, Labor and Pensions Committee, think such a package could lower the unemployment rate by as much as two percentage points.

[…]“I am concerned about the Obama administration’s approach on this,” Harkin said. “It always has been about jobs. I think the administration kind of got snookered talking about the deficit and the debt after the last election.

“The last election was about jobs and the economy, and now we’re in a position where we really do need some economic pump-priming by the federal government,” he said.

Sen. Jay Rockefeller (D-W.Va.), chairman of the Senate Commerce Committee, endorsed Harkin’s argument for more infrastructure spending, and said it is gaining support in the broader caucus.

“There’s very broad support,” Rockefeller said. “There’s no other way to get at this problem.”

Rockefeller said a spending package was discussed at several meetings Wednesday and that there’s a recognition Democrats need to be tougher in negotiations with Republicans.

“We have to be much more aggressive about all this, because as soon as they say ‘We’re not going to do that,’ as they’ve been saying for so long about so many things, you just kind of say ‘oh.’ We’ve got to stop saying ‘oh,’ ” he said, referring to the hard line Republicans have taken for Medicare cuts and against tax increases.

Even centrists like Senate Budget Committee Chairman Kent Conrad (D-N.D.) say a major infrastructure package funded by tax revenue-generating measures is what’s needed to strengthen the economy.

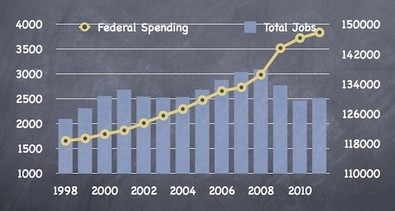

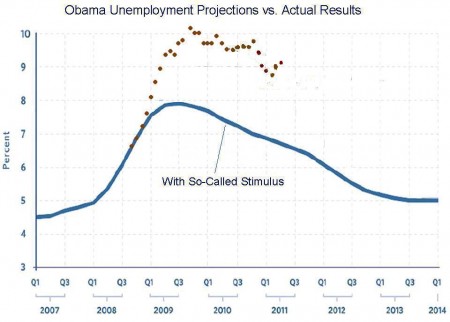

Here’s how well the stimulus spending has been working so far to create jobs:

And more:

It’s not working! And they want more of this.