From the liberal Globe and Mail: IT’S JUST ANOTHER STIMULUS BILL.

Excerpt:

Barack Obama is seeking legislative backing for economic stimulus worth $450-billion (U.S.), making the U.S. President a lonely advocate for spending at a moment dominated by calls for austerity.

Mr. Obama told a joint session of Congress Thursday evening that the United States must get a grip on its rising debt, but not at the expense of condemning millions of people to the unemployment rolls and welfare because traumatized companies refuse to hire.

[…]The President’s proposals Thursday were the same as those telegraphed in the U.S. media over the previous 48 hours. He’s responding to an economy that is quickly losing momentum, expanding at an annual rate of only 0.7 per cent in the first half of the year. The unemployment rate is 9.1 per cent, compared with 8.8 per cent in March, and 14 million Americans are unemployed more than two years into the recovery.

[…]Like the roughly $800-billion stimulus program Mr. Obama shepherded through Congress in early 2009, his new proposal would ease the tax burden on the middle class; send money to states, which have cut almost 500,000 jobs since 2010; and seek to create jobs for millions of unemployed construction workers by plowing millions into refurbishing roads and schools.

[…]The U.S.’s publicly held debt is on track to reach 82 per cent of gross domestic product by the end of the decade, higher than in any year since 1948, according to the Congressional Budget Office.

[…]The U.S. economy is faltering in part because previous stimulus programs are dwindling, while private demand has yet to return in robust way.

[…]Mr. Obama also proposes direct transfers worth $140-billion. Some $35-billion will go to states to help them retain teachers, police officers and fire fighters, while $30-billion would be used to refurbish schools, an initiative the White House likes because the work involved tends to be labour intensive and the contracts can be signed quickly.

I found this amusing summary of the jobs speech on National Review.

Spend $450 billion dollars now, it will create jobs, and I’ll tell you how I’m going to pay for it a week from Monday. If you disagree, you want to expose kids to mercury.

That about sums up the Obama years.

Yes, that about sums it up. Obama says: Let me spend your money on turtle tunnels, or you will be blamed and insulted for being “greedy”.

Fact-checking Obama’s speech

The very liberal AP fact-checks Obama’s speech here. (H/T Doug Ross)

Excerpt:

A look at some of Obama’s claims and how they compare with the facts:

OBAMA: “Everything in this bill will be paid for. Everything.”

THE FACTS: Obama did not spell out exactly how he would pay for the measures contained in his nearly $450 billion American Jobs Act but said he would send his proposed specifics in a week to the new congressional supercommittee charged with finding budget savings. White House aides suggested that new deficit spending in the near-term to try to promote job creation would be paid for in the future – the “out years,” in legislative jargon – but they did not specify what would be cut or what revenues they would use.

Essentially, the jobs plan is an IOU from a president and lawmakers who may not even be in office down the road when the bills come due. Today’s Congress cannot bind a later one for future spending. A future Congress could simply reverse it.

Currently, roughly all federal taxes and other revenues are consumed in spending on various federal benefit programs, including Social Security, Medicare, Medicaid, veterans’ benefits, food stamps, farm subsidies and other social-assistance programs and payments on the national debt. Pretty much everything else is done on credit with borrowed money.

So there is no guarantee that programs that clearly will increase annual deficits in the near term will be paid for in the long term.

—OBAMA: “It will not add to the deficit.”

THE FACTS: It’s hard to see how the program would not raise the deficit over the next year or two because most of the envisioned spending cuts and tax increases are designed to come later rather than now, when they could jeopardize the fragile recovery. Deficits are calculated for individual years. The accumulation of years of deficit spending has produced a national debt headed toward $15 trillion. Perhaps Obama meant to say that, in the long run, his hoped-for programs would not further increase the national debt, not annual deficits.

Let’s now look at some of the specific proposals.

But will it work?

Hans Bader explains the plan in this excellent post at the Competitive Enterprise Institute. (He has lots of links, so I removed them, but you can find them in his post on the CEI web site)

Excerpt:

It contains more money for the long-term unemployed, more infrastructure spending, and funds for hiring laid-off teachers. It also would extend a cut in the portion of payroll taxes paid by employees. The measures would be financed mostly by deficit spending, but partly by raising taxes on the so-called “rich” — a category that includes most of the small business owners who actually hire people — and by eliminating what the administration refers to as “tax loopholes” — which are not really tax loopholes at all, but rather provisions that allow industries disfavored by the administration to benefit from the same tax code provisions as other industries.

[…]Even the least-bad of Obama’s proposals will not grow the economy. Aid for the long-term unemployed will reduce the size of the economy by encouraging some people to not accept jobs that pay far less than they were accustomed to, even when those are the only jobs available to them. Obama’s proposed infrastructure spending will not grow the economy either, as Veronique de Rugy and others note, since it will be accompanied by costly Davis-Bacon mandates designed to favor unions (which raise the cost of transportation projects and exclude many small non-union contractors), and some of it will be wasted on rail boondoggles and pork rather than roads and bridges, or on Obama Administration pet projects, like energy efficiency, that require specialized skills that most unemployed construction workers lack. (Ironically, Obama removed most transportation spending from the original $800 billion stimulus package for political reasons, replacing it with more harmful welfare and social spending.)

How about Obama’s previous stimulus plan?

Meanwhile, by sucking money out of the private-sector economy, the stimulus wiped out a million private-sector jobs, even as other stimulus provisions outsourced American energy jobs to foreign countries, and wiped out jobs in America’s export sector, resulting in a net loss to the economy of 550,000 jobs, according to two economists. The Obama administration’s use of taxpayer money to subsidize above-market wages for government employees is at odds with what economists like Lord Keynes (the father of the Keynesian school of economics) counseled in past recessions, and what Franklin Roosevelt did in the Great Depression, when he hired people to do construction and transportation projects in the WPA but paid them only very modest wages, providing opportunities to the unemployed without siphoning off useful talent from private-sector businesses.

But isn’t it a good idea to help the unemployed and public school teachers?

As the Heritage Foundation notes, “The consequences of extended unemployment benefits are some of the most conclusively established results in labor economic research. Extending either the amount or the duration of UI benefits increases the length of time that workers remain unemployed. UI benefits subsidize unemployment. They reduce the incentive unemployed workers have to search for new work and to make difficult choices–such as moving or switching industries–to begin a new job.”

The President’s proposed subsidies for laid-off teachers discriminate in favor of one occupation, without any legitimate reason for doing so: the unemployment rate among teachers is vastly lower than for many occupations, and lower than for most. It is best understood as the Administration pandering to the teachers’ unions.

This man only has one thing in his mind and it’s spending your children’s money and giving speeches about how great that makes him. He likes to hear the crowds applaud him for spending your children’s money. I do not think well of people who, in tough economic times, come into my house, take my credit card, and spend a bunch of my money on public sector union workers who have job security, benefits and pensions that I can only dream about. Where does he think that the money he is spending comes from in the first place?

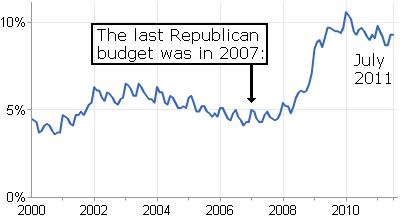

We need an exit strategy from this Keynesian deficit spending quagmire. This man has spent over a trillion dollars on the job-killing Obamacare program, and over a trillion more on stimulus spending. He is running 1.65 trillion dollar annual deficits and he wants to spend even more. And what have we got to show for it? The worst economic recovery in the history of the country – after a recession caused by his own party – and an unemployment rate that is more than double what Bush’s unemployment rate was when he had a Republican House and Senate in 2006.

Related posts

- Obamanomics: $500,000 stimulus grant to grow trees creates 1.72 jobs

- Solar power firm goes bankrupt after receiving $535 million taxpayer dollars

- Public schools spend $130,000 of stimulus money on diversity training books

- Democrat economists: “stimulus” cost $278,000 per job

- Obama blasts private jet tax breaks created by his own stimulus

- Obama spent $80 billion dollars on green jobs so where are the jobs?