Excerpt:

Eight Republican Senators introduced a bill Tuesday giving workers a choice as to whether to join labor unions, which they argue will boost the nation’s economy and provide an increase in wages.

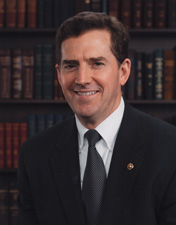

Sen. Jim DeMint (R-S.C.), introduced the National Right to Work Act to “reduce workplace discrimination by protecting the free choice of individuals to form, join, or assist labor organizations, or to refrain from such activities,” according to a statement.

Seven other Republicans signed onto the effort: Sens. Tom Coburn (Okla.), Orrin Hatch (Utah), Mike Lee (Utah), Rand Paul (Ky.), James Risch (Idaho), Pat Toomey (Pa.) and David Vitter (La.).

“Facing a steady decline in membership, unions have turned to strong-arm political tactics to make forced unionization the default position of every American worker, even if they don’t want it,” Hatch said. “This is simply unacceptable. At the very least, it should be the policy of the U.S. government to ensure that no employee will be forced to join a union in order to get or keep their job.

“Republicans cited a recent poll they said shows that 80 percent of union members support having their policy and that “Right to Work” states outperform “forced-union” states in factors that affect worker well being.

From 2000 to 2008, about 4.7 million Americans moved from forced-union to right to work states and a recent study found that there is “a very strong and highly statistically significant relationship between right-to-work laws and economic growth,” and that from 1977 to 2007, right-to-work states experienced a 23 percent faster growth in per capita income than states with forced unionization.

“To see the negative impacts of forced unionization, look no further than the struggling businesses in states whose laws allow it,” Vitter said. “It can’t be a coincidence that right-to-work states have on balance grown in population over the last 10 years, arguably at the expense of heavy union-favoring states.”

DeMint blamed the problems faced by U.S. automakers on the unions.

“Forced-unionism helped lead to GM and Chrysler’s near bankruptcy and their requests for government bailouts as they struggled to compete in a global marketplace,” he said. “When American businesses suffer because of these anti-worker laws, jobs and investment are driven overseas.”

If you want to attract businesses, then you need to have pro-business laws. That’s where jobs come from – businesses.

Here’s an article about states who are trying to pass these laws to attract more employers.

Excerpt:

Currently 14 states beyond Indiana and Wisconsin are considering legislation that would limit union benefits and/or collective bargaining power. They are: Alaska, Hawaii, Maine, Michigan, Minnesota, Missouri, Montana, New Hampshire, New Mexico, Ohio, Pennsylvania, Virginia, Washington (state) and West Virginia. In any number of these states, supporters have planned or held rallies against the measures. But public support might be less than deep. According to a Rasmussen Poll conducted late last week and released Monday, 48 percent of likely U.S. voters sided with Wisconsin Governor Walker whereas only 38 percent sided with his union opponents; the other 14 percent were undecided. And 50 percent of the respondents favored reducing their home state’s government payroll by one percent a year for 10 years either by reducing the work force or reducing their pay. Only 28 percent opposed such action.

This is how we are going to turn the recession around. Cut off the spending on left-wing special interests – NPR, PBS, ACORN, Planned Parenthood, Unions. They all will have to pay their own way, just like the grown-ups do.