The Independent Women’s Forum explains what happened at a panel discussion of women CEOs.

Excerpt:

Rep. Cathy McMorris-Rodgers hosted a panel discussion on Capitol Hill today that focused on the economy and job creation. All of the panelists were CEOs. All of them were women.

In their opening remarks, one word was mentioned by every panelist: uncertainty.

Another word, that went hand-in-hand with the uncertainty that America’s job creators are facing was “regulations.” This word was also mentioned by every panelist.

Sandra Parrillo, President & CEO of Providence Mutual Fire Insurance, said that, as a property and casuality insurance company, they are very familiar with risk. This year has been unprecedented in the amount of claims they’ve paid out due to an usually high number of natural disasters. But Parrillo said her company faces enough uncertainty from nature; they don’t need uncertainty coming from Washington, DC, where hundreds of new rules are being written – often to solve problems that don’t really exist.

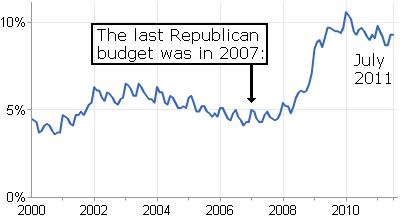

Lisa Hook, President & CEO, Neustar, Inc., said, “The outcome of the budget is less important to us than that there is a budget.” Her company is traded on the stock market, and she says that the uncertainty fueling the ups and downs of the market, often driven by headlines from D.C., affects her business and her borrowing costs.

Several of the panelists derided Congress for failing to pass a budget for FY 2011. They want to know that Congress is working to get its fiscal house in order. They want to know what to expect from the executive branch as well, rather than having to readjust their budgets to deal with costly new regulations as soon as they are written.

Alison Brown, President & CEO, NAVSYS Corporation, went on to explain how difficult it is for small businesses to find access to working capital. She said, “I have had to become my own bank.” Her company isn’t publicly traded, and she pointed to Dodd-Frank and Sarbanes-Oxley as two laws that have wrestled working capital from the hands of small business.

Catherine Heigel, President of Duke Energy South Carolina, echoed the sentiments of the other panelists. She also pointed out Duke Energy would like to repatriate their foreign earnings, but without reform, they would face an effective tax rate of over 50 percent. All of the panelists agreed that certainty (that often comes from having more cash available) could be restored to the American economy with regulatory reform, tax reform, and health care reform. They pointed to these three areas as the areas that currently are most burdensome to businesses.

In many ways the panel today was depressing. All of the CEOs recognized that we are in a tough time, and all of them expressed disappointment that they could not expand and add more jobs in the current business climate.

There is a problem on the left where they have this idea that they can seize profits, control businesses, impose politically correct agendas, and engage in judicial activism and businesses will just keep hiring, producing and so on. It’s the ultimate narcissism. Bureaucrats are so busy spending other people’s money and making speeches about how generous they are that they completely forget who is paying the bill.