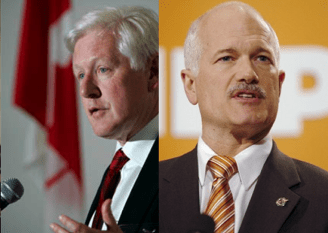

Jack Layton is opposed to free trade with other nations, and Jack Layton supports the imposition of tariffs on imported goods. Stephen Harper favors free trade and opposes tariffs, and has pushed through numerous free trade deals during his terms in office. So now we have to ask the questions: is free trade good for Canada? Is free trade good for Canadian consumers? Is free trade good for Canadian companies? Is free trade good for the poor in other countries?

Let’s start by noting that free trade is supported by virtually ALL economists, regardless of their political persuasion. Moderate economist Gregory Mankiw of Harvard University lists the policies that are accepted by virtually all economists.

Here’s Greg’s list, together with the percentage of economists who agree:

- A ceiling on rents reduces the quantity and quality of housing available. (93%)

- Tariffs and import quotas usually reduce general economic welfare. (93%)

- Flexible and floating exchange rates offer an effective international monetary arrangement. (90%)

- Fiscal policy (e.g., tax cut and/or government expenditure increase) has a significant stimulative impact on a less than fully employed economy. (90%)

- The United States should not restrict employers from outsourcing work to foreign countries. (90%)

- The United States should eliminate agricultural subsidies. (85%)

- Local and state governments should eliminate subsidies to professional sports franchises. (85%)

- If the federal budget is to be balanced, it should be done over the business cycle rather than yearly. (85%)

- The gap between Social Security funds and expenditures will become unsustainably large within the next fifty years if current policies remain unchanged. (85%)

- Cash payments increase the welfare of recipients to a greater degree than do transfers-in-kind of equal cash value. (84%)

- A large federal budget deficit has an adverse effect on the economy. (83%)

- A minimum wage increases unemployment among young and unskilled workers. (79%)

- The government should restructure the welfare system along the lines of a “negative income tax.” (79%)

- Effluent taxes and marketable pollution permits represent a better approach to pollution control than imposition of pollution ceilings. (78%)

Now let’s drill down to the research on free trade in particular.

Here’s an article from the libertarian Cato Institute, a respected think tank.

Excerpt:

There are three important reasons voluntary exchange is good not only for the contracting parties but the world as a whole:

(1) Trade improves global efficiency in resource allocation. A glass of water may be of little value to someone living near the river but is priceless to a person crossing the Sahara. Trade delivers goods and services to those who value them most.

(2) Trade allows partners to gain from specializing in the producing those goods and services they do best. Economists call that the law of comparative advantage. When producers create goods they are comparatively skilled at, such as Germans producing beer and the French producing wine, those goods increase in abundance and quality.

(3) Trade allows consumers to benefit from more efficient production methods. For example, without large markets for goods and services, large production runs would not be economical. Large production runs, in turn, are instrumental to reducing product costs. Lower production costs lead to cheaper goods and services, which raises real living standards.

Evidence supports the idea nations more open to trade tend to be richer than those that are less open. Columbia University economist Arvind Panagariya wrote in a paper “Miracles and Debacles: Do Free-Trade Skeptics Have a Case?”: “On the poverty front, there is overwhelming evidence that trade openness is a more trustworthy friend of the poor than protectionism. Few countries have grown rapidly without a simultaneous rapid expansion of trade. In turn, rapid growth has almost always led to reduction in poverty.”

According to the Cato Institute’s 2004 report on Economic Freedom of the World, which measures economic freedom in 123 countries, the per capita gross domestic product in the quintile of countries with the most restricted trading was only $1,883 in 2002. That year’s per capita GDP in the quintile of countries with the freest trading regimes was $23,938.

Harper holds the B.A. and the M.A. in economics from the University of Calgary. He knows this stuff cold.

Here’s an article from The Heritage Foundation, another think tank. This article outlines five reasons why free trade is the best economic policy.

Here is an excerpt from one reason from the list of five:

REASON #1: Higher Standard of Living

The most compelling reason to support free trade is that society as a whole benefits from it. Free trade improves people’s living standards because it allows them to consume higher quality goods at less expensive prices. In the 19th century, British economist David Ricardo showed that any nation that focuses on producing goods in which it has a comparative advantage will be able to get cheaper and better goods from other countries in return. As a result of the exchange, both trading parties gain from producing more efficiently and consuming higher quality goods and services at lower prices.

Trade between nations is the same as trade between people. Consider what the quality of life would be if each person had to produce absolutely everything that he or she consumed, such as food, clothing, cars, or home repairs. Compare that picture with life as it is now as individuals dedicate themselves to working on just one thing–for example, insurance sales–to earn a salary with which they can freely purchase food, a car, a home, clothing, and anything else they wish at higher quality and lower prices than if they had done it themselves.

It simply makes sense for each person to work at what he or she does best and to buy the rest. As a nation, the United States exports in order to purchase imports that other nations produce more skillfully and cheaply. Therefore, the fewer barriers erected against trade with other nations, the more access people will have to the best, least expensive goods and services in the world “supermarket.”

Producers benefit as well. In the absence of trade barriers, producers face greater competition from foreign producers, and this increased competition gives them an incentive to improve the quality of their production while keeping prices low in order to compete. At the same time, free trade allows domestic producers to shop around the world for the least expensive inputs they can use for their production, which in turn allows them to keep their cost of production down without sacrificing quality.

In the end, the results benefit both producers–who remain competitive and profitable–and consumers–who pay less for a good or a service than they would if trade barriers existed.

There is no loser to free trade exchanges, otherwise the participants to the trade would not make the trade at all. Both parties gain – that’s why they choose to make the trade.

NDP candidates are not economists

NDP candidates are not known for their demonstrated knowledge and experience in economics, unlike Stephen Harper.

Excerpt:

Usually an election call means all bets are off for politicos wanting to take a Vegas vacation.

But, if you’re a New Democrat, you can be in Sin City with just days to go in the federal election campaign.

That’s where the party’s long shot candidate for the Quebec riding of Berthier-Maskinonge, Ruth Ellen Brosseau, finds herself.

Ruth works in the campus pub at Carleton University. She is not an economist.

But there’s more:

Some NDP candidates in Quebec could prove to be wild cards if they end up winning on May 2.

Several are still university students.

Charmaine Borg in Terrebonne-Blainville and Sherbrooke candidate Pierre-Luc Dusseault are both studying political science.

Actress and former camp counsellor Marie-Claude Morin in Saint-Hyacinthe-Bagot is working on a degree in social work.

Others have off-beat political backgrounds.

Alexandre Boulerice, the NDP candidate in Rosemont-La Petite-Patrie, is a member of the left-wing separatist party Quebec Solidaire.

In the Pontiac riding, the New Democrats have nominated Mathieu Ravignat. He was a Communist Party candidate in the Montreal area in 1997.

You can watch a video report on some of the NDP candidates here at Blazing Cat Fur.

How did former NDP leader Bob Rae govern in Ontario?

If you want to know what New Democrats do to an economy, you can read about how NDP leader Bob Rae wrecked the Ontario economy in the 1990s.

Excerpt:

The Liberal government had forecast a small surplus earlier in the year, but a worsening North American economy led to a $700 million deficit before Rae took office. In October, the NDP projected a $2.5 billion deficit for the fiscal year ending on March 31, 1991.[40] Some economists projected soaring deficits for the upcoming years, even if the Rae government implemented austerity measures.[41] Rae himself was critical of the Bank of Canada’s high interest rate policy, arguing that it would lead to increased unemployment throughout the country.[42] He also criticized the 1991 federal budget, arguing the Finance Minister Michael Wilson was shifting the federal debt to the provinces.[43]

The Rae government’s first budget, introduced in 1991, increased social spending to mitigate the economic slowdown and projected a record deficit of $9.1 billion. Finance Minister Floyd Laughren argued that Ontario made a decision to target the effects of the recession rather than the deficit, and said that the budget would create or protect 70,000 jobs. It targeted more money to social assistance, social housing and child benefits, and raised taxes for high-income earners while lowering rates for 700,000 low-income Ontarians.[44]

A few years later, journalist Thomas Walkom described the budget as following a Keynesian orthodoxy, spending money in the public sector to stimulate employment and productivity. Unfortunately, it did not achieve its stated purpose. The recession was still severe. Walkom described the budget as “the worst of both worlds”, angering the business community but not doing enough to provide for public relief.

[…]Rae’s government attempted to introduce a variety of socially progressive measures during its time in office, though its success in this field was mixed. In 1994, the government introduced legislation, Bill 167, which would have provided for same-sex partnership benefits in the province. At the time, this legislation was seen as a revolutionary step forward for same-sex recognition.

[…]The Rae government established an employment equity commission in 1991,[49] and two years later introduced affirmative action to improve the numbers of women, non-whites, aboriginals and disabled persons working in the public sector.

[…]In November 1990, the Rae government announced that it would restrict most rent increases to 4.6% for the present year and 5.4% for 1991. The provisions for 1990 were made retroactive. Tenants’ groups supported these changes, while landlord representatives were generally opposed.

Be careful who you vote for, Canada. We voted for Obama, and now we have a 14.5 trillion dollar debt and a 1.65 trillion deficit – TEN TIMES the last Republican budget deficit of 160 billion under George W. Bush in 2007. TEN TIMES WORSE THAN BUSH.

Related posts

- NDP leader Jack Layton lived in subsidized housing with $120,000 income

- NDP leader Jack Layton promises to promote greater access to abortion

- NDP leader Jack Layton would kill jobs and raise energy prices with cap-and-trade

- NDP leader Jack Layton gets medical care at private clinic instead of public hospital

- NDP leader Jack Layton wants consumers to pay higher prices for lower quality goods