Story from CBS News. (H/T ECM)

Excerpt:

Governor David Paterson said Tuesday that the days of profligate spending in Albany are over and that starting immediately lawmakers must participate in an “age of accountability.”

That said, the governor’s new budget has $1 billion in new taxes and nearly $800 million in cuts for New York City.

[…]”Our revenues have crumbled and our budget has crashed and we can no longer afford this spending addiction that we have had for so long,” Paterson said.

[…]”The mistakes of the past have lead us to the breaking point,” Paterson said.

But in addition to the severe belt tightening, the governor said he would need to raise $1 billion in new taxes and fees — some politically controversial.

* A $1 increase in the cigarette tax, raising the state tax to $3.75.

* A new soda tax that will cost consumers 1-cent per ounce — a 16-ounce bottle will cost 16 cents more, a 64-ounce bottle 64 cents more.

* The governor also plans to legalize and sanction cage fighting.

* And allow wine to be sold in grocery stores.

* And introduce 50 speed cameras on highways to catch unsuspecting motorists with fines of up to $100.

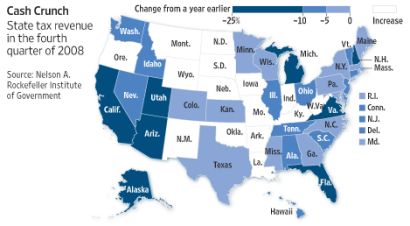

How did this happen?

New York legislators voted to tax the wealthy.

Then the wealthy left New York for red states.

And now Albany has no revenues to pay for all of their government spending on social programs, such as paying delinquent teachers to do nothing all day because the teacher unions won’t allow teachers to be fired, no matter how badly they screw up.

Governor Patterson never wanted anything to do with earlier tax increases on the wealthy. At least these new tax increases are on consumption, not on income, and not on corporations. Consumption taxes cost the fewest jobs, in my opinion. Consumption taxes encourage saving, too.