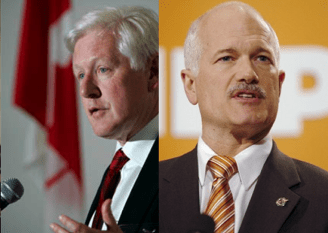

Conservative Party leader Stephen Harper announces his tax cut plan for families.

Excerpt:

Prime Minister Stephen Harper announced today that a re-elected Conservative Government will continue to implement low-tax measures to improve the quality of life of Canadian families.

“The Conservative Party believes in low taxes for Canadian families, because we know household budgets are tight,” said Mr. Harper. “A re-elected Conservative Government will continue to keep taxes down for families so they can keep more of their hard-earned money to spend on what matters to them.”

Budget 2011, the Next Phase of Canada’s Economic Action Plan, included concrete measures to keep taxes down for Canadian families. These include a new Family Caregiver Tax Credit to help around 500,000 families with the cost of caring for an infirm child or an aging parent, and the elimination of the $10,000 cap on the Medical Expense Tax Credit for any expenses incurred in caring for a financially-dependent relative. Our 2011 Budget — opposed by the Ignatieff Liberals and their Coalition partners, the NDP and Bloc Québécois — would also create a new $500 Children’s Arts Tax Credit to help parents cover the cost of putting their children in artistic, cultural, recreational and developmental activities.

“It is important for a Conservative Government to make Canadian families one of our key priorities,” said Mr. Harper. “That is why we will introduce measures to help caregivers, people who make sacrifices for their families, with concrete, affordable measures.”

Prime Minister Harper also reiterated his commitment to double to $1,000 the amount of the Children’s Fitness Tax Credit and to introduce the Family Tax Cut, income-sharing for families with children under the age of 18 years old, once the Government eliminates the deficit in 2014.

Stephen Harper’s Conservative Government cut taxes for Canadian families by more than $3,000 on average.

Prime Minister Harper observed that the Coalition of the Ignatieff Liberals, the NDP and the Bloc Québécois has the wrong priorities with their plan to raise taxes on Canadian families and ignore the choices that families make. “The choice is clear,” Mr. Harper said. “Canadians can choose between our low-tax plan for families and their high-tax agenda that will set you and your family back.”

Stephen Harper would also pass a bill to get tough on crime and criminals, in order to protect law-abiding Canadian families.

Related posts

- Should pro-life social conservatives vote for Stephen Harper?

- Conservative Party unveils plan to promote religious liberty abroad

- Stephen Harper wins English-language election debate

- Stephen Harper’s Conservatives unveil “Here for Canada” platform

- Harper would ban political contributions from unions and corporations

- A closer look at Stephen Harper’s Family Tax Cut plan

- Poll finds 68% of Canadians positive on Canadian economy

- Canada created twice the number of jobs as the United States in January

- Canadian prime minister Stephen Harper vows to end long-gun registry

- Stephen Harper makes a stand against North Korean aggression

- Fiscally conservative Canada campaigns against global bank tax

- Federal conservatives in Canada aim to cut spending and waste from budget

- Canada’s finance minister proposes changes to mortgage lending laws

- Supreme Court sides with Conservative Party against price-fixing monopoly

- Canadian prime minister Stephen Harper seeks increased trade with India

- Canadian Evangelicals and Catholics more opposed to secularism and socialism

- Members of Canadian socialist parties oppose child sex-trafficking crime bill

- Harper instructs foreign minister to denounce Libyan dictator

- Canadians to walk out of Ahmadinejad’s speech at UN

- Canada signs free trade deal with Panama

- Harper pays surprise visit to troops in Afghanistan

- Investors Business Daily says Harper better leader than Obama

- Round-up of US news media interviews with Stephen Harper