I found this article from MSNBC on The Other McCain.

Excerpt:

Political leaders in Athens were due to discuss an emergency government Wednesday to deal with a possible run on banks as it emerged Greeks withdrew almost $900 million in a single day, fearing their country could crash out of the euro currency by the end of the week.

An interim government would take the country through to new elections on June 17, triggered by the collapse on Tuesday of talks to form a coalition between winners of the inconclusive May 6 election.

Greeks are withdrawing euros from banks, apparently afraid of the prospect of rapid devaluation if the country leaves the European single currency and returns to the drachma.

President Karolos Papoulias warned of “great fear that could develop into a panic,” the minutes of Papoulias’ negotiations with political leaders showed, according to Reuters.

[…]Several banking sources told Reuters similar amounts had also been withdrawn on Tuesday. Nevertheless, there was no sign of panic or queues at bank branches in Athens on Wednesday. Bankers dismissed suggestions that a bank run was looming. A senior executive at a large Greek bank told Reuters: “There is no bank run, no queues or panic. The situation is better than I expected. The amount of deposit withdrawals the president mentioned referred to three days, not one.”

[…]Greeks have already been withdrawing their savings from banks at a sharp clip – nearly a third of bank deposits were withdrawn between January 2010 and March 2012, reducing total Greek household and business deposits to 165 billion euros.

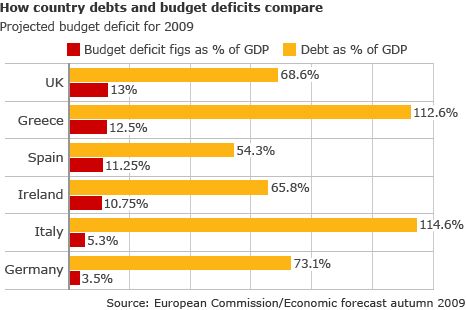

What I find really striking about stories like this is that Greece just had an election. 75% of them want to stay in the European Union and keep the Euro as a currency. But that can only happen if they accept that they are spending too much and they are not producing anything. They have to cut spending, lower taxes and deregulate so that there is economic growth. So what did they do? They voted against austerity. They think that by refusing to meet the conditions of the people who can bail them out, that they will get a bailout. It’s just insane. Like whipping a thirsty camel with the expectation that whipping can somehow satiate its thirst and cause it to get up and keep moving.