Surprise! It already is happening here. Thomas Sowell explains in the American Spectator.

Excerpt:

One of the big differences between the United States and Cyprus is that the U.S. government can simply print more money to get out of a financial crisis. But Cyprus cannot print more euros, which are controlled by international institutions.But could similar policies be imposed in other countries, including the United States?

Does that mean that Americans’ money is safe in banks? Yes and no.

The U.S. government is very unlikely to just seize money wholesale from people’s bank accounts, as is being done in Cyprus. But does that mean that your life savings are safe?

No. There are more sophisticated ways for governments to take what you have put aside for yourself and use it for whatever the politicians feel like using it for. If they do it slowly but steadily, they can take a big chunk of what you have sacrificed for years to save, before you are even aware, much less alarmed.

That is in fact already happening. When officials of the Federal Reserve System speak in vague and lofty terms about “quantitative easing,” what they are talking about is creating more money out of thin air, as the Federal Reserve is authorized to do — and has been doing in recent years, to the tune of tens of billions of dollars a month.

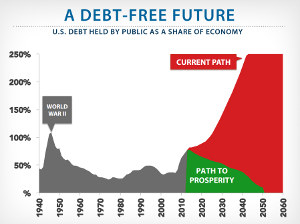

When the federal government spends far beyond the tax revenues it has, it gets the extra money by selling bonds. The Federal Reserve has become the biggest buyer of these bonds, since it costs them nothing to create more money.

This new money buys just as much as the money you sacrificed to save for years. More money in circulation, without a corresponding increase in output, means rising prices. Although the numbers in your bank book may remain the same, part of the purchasing power of your money is transferred to the government. Is that really different from what Cyprus has done?

I noticed that Brian Lilley had an article about whether Cyprus-style confiscations could happen in Canada. The short answer: yes – for amounts above $100,000 Canadian.