Conservative M.P. Pierre Poilevre (Nepean-Carleton), a member of the majority government in Canada, explains how Canada embraced the free entreprise system that America has rejected, and the results they got.

Here is the speech that went viral on Youtube:

And here is his article in the liberal Huffington Post.

Excerpt:

In a few days the “fiscal cliff” deadline will arrive and potentially bring massive automatic spending cuts and tax increases. Even if Congress and the President agree to avoid the cliff, the next crisis awaits. Treasury Secretary, Timothy Geithner, wrote the Senate this week to report that the “statutory debt limit will be reached on December 31, 2012,” which will require extraordinary measures to prevent a mass default. These measures will give the government 60 days before it runs out of money and Uncle Sam’s head smashes into the so-called “debt ceiling.”

It has long been said that when the U.S. sneezes, Canada catches a cold. So why have these debt-related ailments in the U.S. not afflicted the Canadian government?

The answer is that Canada has been practicing what the U.S. always preached: free markets, low taxes and minimal state interference. And it is working.

For example, Canada avoided the interventionist policies that led the U.S. to the sub-prime crisis.

In an attempt to expand home ownership, administrations from Carter to Bush Jr. forced banks to offer mortgages to people who would otherwise not qualify for them. Washington then ordered government-sponsored enterprises such as Freddie Mac and Fannie Mae to insure these “sub-prime” mortgages.

According to a 2010 Report on the U.S. Financial Crisis by the World Bank’s Development Research Group, Freddie and Fannie bought an estimated 47 per cent of these toxic mortgages. Harvard financial historian Niall Ferguson indicates that the amount of mortgage debt backed by these government-sponsored enterprises grew from $200-million in 1980 to $4-trillion in 2007.(1) The government pumped so much air into the housing bubble that it burst in 2008. The resulting financial crisis led to government bailouts of the banking sector.

Big government caused the economic crisis. So we are told the solution is more big government. Funny how the problem becomes the solution.

Because the Canadian government did not impose sub-prime mortgages on the country’s charter banks, we avoided the crisis and did not bailout a single financial institution. To keep it that way, Canada’s Finance Minister has ended all government-backed insurance of low-down payment and long-amortization mortgages. In other words, if you want to take on risky debt, taxpayers will not insure you.

Governments must lead by example when managing their own debt and spending. Low debt is the result of low spending. Federal government spending as a share of the overall economy is 15 per cent in Canada (2) and 24 per cent in the U.S. (3). The numbers are not merely the result of prodigious U.S. military spending, though that is certainly a factor. Non-military federal government spending is 14 per cent of Canada’s economy (4), and 18 per cent of America’s (5).

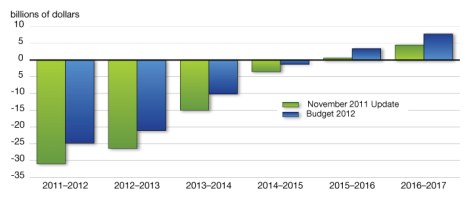

Take a look at some of these graphs from earlier in the year about the Canadian 2012 budget. (This is straight from their government’s web site – they have new transparency/anti=corruption measures now, so the citizens know everything that government does). When comparing the deficit and debt of Canada to the United States, always multiply the Canadian number by 10 to get a benchmark to compare. For example, Canadian GDP is 1.7 trillion, and the US GDP is 15 trillion.

Canada’s budget deficit is around 30 billion, but ours is 1.2 trillion:

If we were doing as well as Canada, our deficit would be about $300 billion. But we have run up about 6 trillion in debt over 4 years! Not only that, but Canada’s national debt is only $600 billion. If we multiple that by 10, we would expect ours about $6 trillion. And it was that – during the Bush Presidency. But then the Democrats took over the House and Senate in 2007 and everything went wrong and we packed trillions and trillions onto the debt, including about $6 trillion during Obama’s first term.

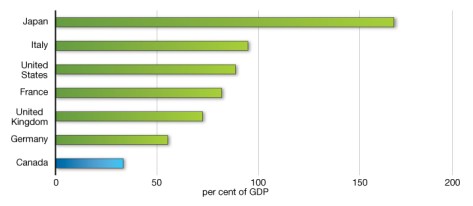

Canada’s Debt to GDP ratio is 34%:

But things are even worse for the United States, now. The current United States Debt to GDP is 105%, according to official U.S. government figures. We are due for yet another credit downgrade, and should see Greece-like levels of Debt to GDP during Obama’s second term. We are spending too much, and we aren’t going to be able to make up trillion dollar deficits even if we confiscate every penny that rich people earn. (And they won’t be daft enough to keep working as hard if we did that – they would move, and probably to Canada)

What is happening to us here in the United States is self-inflicted. We are – and have been – voting to impoverish ourselves and generations of children born and unborn, by punishing those who work hard and play by the rules, and rewarding those who don’t work and don’t play by the rules. It didn’t have to be this way. We could have elected a President who actually knew something about business and economics. Knowledge matters. We can’t just choose a President who gives us the “tingles” and then expect him to perform the actual duties of being President. Competence is more important than confidence. Substance is more important than style.