Let’s take a look at the budget deficits again, keeping in mind that the last Republican budget was the 2007 budget. In January of 2007, the Democrats took control of the House and Senate, and all spending was in Democrat control until January of 2011, when the Republicans took back the House.

Next, let’s see what impact the Bush tax cuts from 2001 and 2003 had on tax revenue:

From the chart:

- Revenue in 2001 was 2.0 trillion in the year of the first round of tax cuts

- Revenue in 2003 was 1.8 trillion in the year of the second round of tax cuts

- Revenue then rose in each subsequent year, ending at 2.6 trillion in 2007, when the Democrats took over the House and Senate

- In 2007, Bush was only spending about 2.8 trillion – very close to what he was taking receiving in tax revenues

- The budget deficit went down in each year after both tax cuts were in place (2004), until the Democrats took over the House and Senate

- Obama is currently spending over 3.8 trillion per year, but he is only receiving about 2.2 trillion in revenue.

- It’s a spending problem, not a revenue problem

Doug Ross explains:

According to the OMB’s own figures, the Bush tax cuts resulted in an explosion of revenue to the U.S. government.

That’s not to say Bush wasn’t a profligate spender — he was. But in virtually no cases were Democrats arguing that he spend less (unless you count national security).

In fact, fiscal conservatives opposed Bush’s absurd policies on spending, amnesty and the expansion of Medicare.

But no one in world history has ever spent money like Barack Obama.

These statements are indisputable.

Which is why they are certain to be rejected by the diminishing cadre of Obama-Democrat drones, who appear to be completely immune to facts, logic and reason.

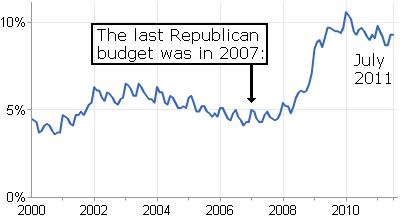

And let’s just see what happened to the unemployment rate since the Democrats took over spending in January of 2007:

There are a lot of people who don’t know about these numbers because they watch Jon Stewart and Stephen Colbert on the Comedy Channel, or Rachel Maddow and Ed Schulz on MSNBC.

I actually spoke to someone who voted for Obama about these numbers. He said that 2.6 trillion in tax revenues was worse than 2.0 trillion in tax revenues. And he said that a 4.3% unemployment rate was WORSE than a 9.2% unemployment rate. And he also said that a $160 billion dollar deficit was WORSE than a $1650 billion dollar deficit. Ok I just made that up, but still. That’s how Democrats think. Tax and spend.