Here’s the analysis of Obama’s budget. (H/T The Blog Prof)

Excerpt:

President Obama released his budget this morning. Rather than focusing on Washington’s over-spending problem, the budget calls for higher taxes on families and small businesses to pay for even more government spending. Under the Obama budget, tax revenues will grow from 14.4% of GDP in 2011 to 20% of GDP in 2021. By comparison, the historical average is only 18% of GDP.

Tax hike lowlights include:

- Raising the top marginal income tax rate (at which a majority of small business profits face taxation) from 35% to 39.6%. This is a $709 billion/10 year tax hike

- Raising the capital gains and dividends rate from 15% to 20%

- Raising the death tax rate from 35% to 45% and lowering the death tax exemption amount from $5 million ($10 million for couples) to $3.5 million. This is a $98 billion/ten year tax hike

- Capping the value of itemized deductions at the 28% bracket rate. This will effectively cut tax deductions for mortgage interest, charitable contributions, property taxes, state and local income or sales taxes, out-of-pocket medical expenses, and unreimbursed employee business expenses. A new means-tested phaseout of itemized deductions limits them even more. This is a $321 billion/ten year tax hike

- New bank taxes totaling $33 billion over ten years

- New international corporate tax hikes totaling $129 billion over ten years

- New life insurance company taxes totaling $14 billion over ten years

- Massive new taxes on energy, including LIFO repeal, Superfund, domestic energy manufacturing, and many others totaling $120 billion over ten years

- Increasing unemployment payroll taxes by $15 billion over ten years

- Taxing management capital gains in an investment partnership (“carried interest”) as ordinary income. This is a tax hike of $15 billion over ten years

- A giveaway to the trial lawyers—not letting companies deduct the cost of punitive damages from a lawsuit settlement. This is a tax hike of $300 million over ten years

- Increasing tax penalties, information reporting, and IRS information sharing. This is a ten-year tax hike of $20 billion.

Add it all together, and this budget is a ten-year, $1.5 trillion tax hike over present law. That’s $1.5 trillion taken out of the economy and spent on government instead of being used to create jobs.

The “tax relief” in the budget is mostly just an extension of present law, and also some refundable credit outlay spending in the tax code. There is virtually no new tax relief relative to present law in the President’s budget.

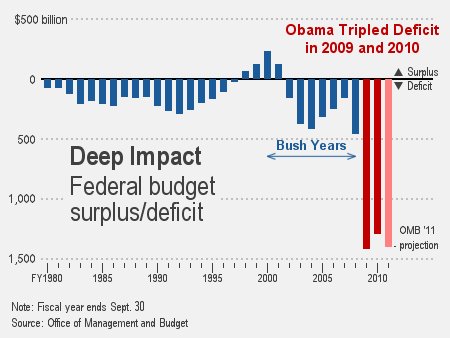

So then how can the Obama administration claim that they are being fiscally responsible? Let’s see how. (H/T Hyscience)

Excerpt:

The Obama administration’s statement that the government will not be adding to the debt by the middle of the decade clashes hard against the facts, Republicans say, leaving officials straining to justify the budget claim they’ve pushed repeatedly over the past few days.

As it turns out, the administration is not counting interest payments. That means the budget team plans to have enough money to pay for ordinary spending programs by the middle of the decade. But it won’t have the money to pay off those pesky — rather, gargantuan — interest payments. So it will have to borrow some more, in turn increasing the debt and increasing the size of future interest payments year after year.

So how then, visibly agitated Republicans asked, can the administration claim that its 2012 spending plan sets the country on a course to “pay for what we spend” in just a few years?

Hyscience also linked to this McClatchy news article.

Excerpt:

He overlooks the fact that the government still would have to borrow to pay interest on the debt, much of it run up on his watch. Despite achieving “primary balance” in fiscal 2017, the government would have to borrow $627 billion to pay $627 billion in interest. Interest payments would rise annually through 2021.

Debt would rise as well, according to Obama’s proposed budget. Despite the budget reaching “primary balance,” the total gross government debt would rise from $21.9 trillion in fiscal 2017 to $22.9 trillion in 2018, $24 trillion in 2019, $25.2 trillion in 2020 and $26.3 trillion in 2021.

In all, the debt would jump by nearly $4.5 trillion in the four years after the government supposedly would stop adding to the debt because it had achieved “primary balance” – and that’s according to his own budget.

And a non-partisan fact-checking organization has found that Obama is lying about the budget. You can bet that the mainstream media will be backing him up, though.