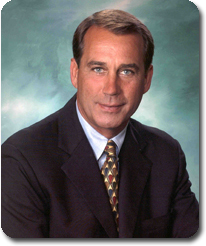

I spotted this scary post over at John Boehner’s blog. The post, written by Kevin Lewis, links to this AP article that highlights a new study from the Lewin Group. I blogged before about the Democrats’ plan to equalize life outcomes and redistribute wealth by nationalizing health care. Now we get more details of how they’ll do it.

Here is a summary of the Democrats’ plan:

President Barack Obama and many Democrats want to create a government insurance plan to compete with private plans that now cover about 170 million Americans. The issue is major sticking point for Republicans and the insurance industry.

And the predicted results of that plan:

The Lewin study found that if such a plan were open to all employers and individuals, and if it paid doctors and hospitals the same as Medicare, the government plan would quickly grow to 131 million members, while enrollment in private insurance plans would plummet.

“The private insurance industry might just fizzle out altogether,” said John Sheils, a Lewin vice president and leading author of the study.

By paying Medicare rates the government plan would be able to set premiums well below what private plans charge. Monthly premiums for family coverage would be $761 in the government plan, compared with an average of $970 in private plans, the study estimated. Employers and individuals would flock to the public plan to cut costs.

Lewis cites two of the study‘s key findings:

“If as the President proposed, eligibility is limited to only small employers, individuals and the self-employed … The number of people with private coverage would fall by 32.0 million people.”

“If the public plan is opened to all employers as proposed by former Senators Clinton and Edwards, at Medicare payment levels … The number of people with private health insurance would decline by 119.1 million people. This would be a two-thirds reduction in the number of people with private coverage (currently 170 million people).”

More here at the Heritage Foundation.

Further study

Here are some previous links that are relevant:

- The libertarian Cato Institute’s Michael Tanner explains the features of the Democrats’ health care plan

- Senator Jim Demint introduces a bill to prevent the Democrats from restricting choice in health care

- Democrats block Senator Tom Coburn’s amendment to defend the conscience rights of medical professionals

- An analysis of good health care policies in Ireland, and bad ones in the UK

- Massachusetts state-run health care costs are spiraling out of control

- Economist Walter Williams evaluates Sweden’s health care system

- The provision in Porkulus-1 that gave Washington control of your health care decisions

- The anti-science funding of useless ESCR instead of useful ASCR to appease pro-abortion special interests

- A damning assessment, with video clips, of Canada’s single-payer socialized medicine system