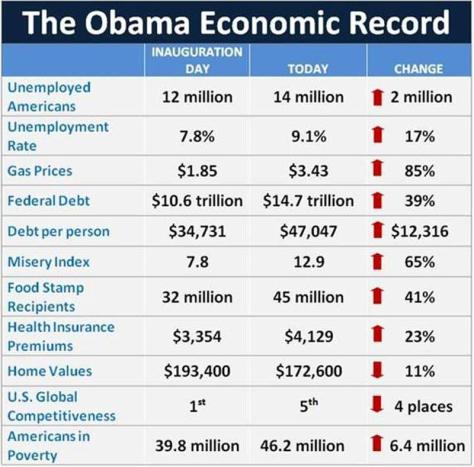

Investors Business Daily explains the latest speech on economics from the man who has doubled Bush’s 2007 unemployment rate, and increased Bush’s 2007 budget deficits tenfold.

Excerpt:

One thing is certainly true about President Obama — no matter how many times people point out the falsehoods in his speeches, he just keeps making them. Case in point: his latest “economic fairness” address.

In that speech Tuesday, Obama once again tried to build a case for his liberal, big-spending, tax-hiking, regulatory agenda. But as with so many of his past appeals, Obama’s argument rests on a pile of untruths. Among the most glaring:

• Tax cuts and deregulation have “never worked” to grow the economy. There’s so much evidence to disprove this claim, it’s hard to know where to start. But let’s begin with the fact that countries with greater economic freedom — lower taxes, less government, sound money, free trade — consistently produce greater overall prosperity.

Here at home, President Reagan’s program of lower taxes and deregulation led to an historic two-decade economic boom. Plus, states with lower taxes and less regulation do better than those that follow Obama’s prescription.

Obama also claimed the economic booms in the ’50s and ’60s somehow support his argument. This is utter nonsense. Taxes at the time averaged just 17% of the economy. And there was no Medicare, no Medicaid, no Departments of Transportation, Energy or Education, and no EPA. Had Obama been around then, he would have decried it all as un-American.

• Bush’s tax cuts on the rich only managed to produced “massive deficits” and the “slowest job growth in half a century.” Budget data make clear that Obama’s spending hikes, not Bush’s tax cuts, produced today’s massive deficits.

And Obama only gets his “slowest job growth” number by including huge job losses during his own term in office. Also, monthly pre-recession job growth under Bush was about 40% higher than post-recession growth has been under Obama.

• During the Bush years, “we had weak regulation, we had little oversight.” This is patently false. Regulatory staffing climbed 42% under Bush, and regulatory spending shot up 50%, according to a Washington University in St. Louis/George Washington University study. And the number of Federal Register pages — a proxy for regulatory activity — was far higher under Bush than any previous president.

• The “wealthiest Americans are paying the lowest taxes in over half a century.” Fact: the federal income tax code is now more progressive than it was in 1979, according to the Congressional Budget Office. IRS data show the richest 1% paid almost 40% of federal income taxes in 2009, up from 18% back in 1980.

• We can keep tax breaks for the rich in place, or make needed investments, “but we can’t do both.” Not true. Repealing the Bush tax cuts on the “rich” would raise only about $70 billion a year, a tiny fraction of projected deficits. With or without the Bush tax cuts, the country can’t afford Obama’s agenda.

The Heritage Foundation describes the effects of the Bush tax cuts.

Excerpt:

President Bush signed the first wave of tax cuts in 2001, cutting rates and providing tax relief for families by, for example, doubling of the child tax credit to $1,000.

At Congress’ insistence, the tax relief was initially phased in over many years, so the economy continued to lose jobs. In 2003, realizing its error, Congress made the earlier tax relief effective immediately. Congress also lowered tax rates on capital gains and dividends to encourage business investment, which had been lagging.

It was the then that the economy turned around. Within months of enactment, job growth shot up, eventually creating 8.1 million jobs through 2007. Tax revenues also increased after the Bush tax cuts, due to economic growth.

In 2003, capital gains tax rates were reduced. Rather than expand by 36% as the Congressional Budget Office projected before the tax cut, capital gains revenues more than doubled to $103 billion.

The CBO incorrectly calculated that the post-March 2003 tax cuts would lower 2006 revenues by $75 billion. Revenues for 2006 came in $47 billion above the pre-tax cut baseline.

Here’s what else happened after the 2003 tax cuts lowered the rates on income, capital gains and dividend taxes:

- GDP grew at an annual rate of just 1.7% in the six quarters before the 2003 tax cuts. In the six quarters following the tax cuts, the growth rate was 4.1%.

- The S&P 500 dropped 18% in the six quarters before the 2003 tax cuts but increased by 32% over the next six quarters.

- The economy lost 267,000 jobs in the six quarters before the 2003 tax cuts. In the next six quarters, it added 307,000 jobs, followed by 5 million jobs in the next seven quarters.

The timing of the lower tax rates coincides almost exactly with the stark acceleration in the economy. Nor was this experience unique. The famous Clinton economic boom began when Congress passed legislation cutting spending and cutting the capital gains tax rate.

If, in the 2012 election, half the country decides to vote for the person who gives the best speeches and who is cheered on the Comedy Channel, then we are going to have four more years of 9% unemployment and 1.4 trillion dollar deficits. Barack Obama knows nothing whatsoever about economics.

UPDATE: Obama says that small business owners didn’t build their own businesses

One thing worth noting.

Alan Greenspan crushed interest rates in 2003.

Led to housing bubble.

LikeLike

Very true, that was a major factor, but you have to understand that the housing bubble was localized to a few markets with restrictions on new housing construction caused by the left. That caused home prices to rise a lot in places like San Francisco, whereas home prices rose far less fast in Houston, for example. Make sense?

Read:

http://www.nationalreview.com/articles/print/227468

Quote:

Do you know who is in charge in San Francisco? Democrats.

LikeLike