In America, one of the political parties is dominated by people who were born into rich families and have never run any business – not even a lemonade stand. Try contrasting people like Howard Dean or Al Gore with Representatives John Campbell or Michele Bachmann. And there are consequences to being sheltered from the realities of commerce and economics your entire life.

The Wall Street Journal reports: (H/T The Tax Foundation)

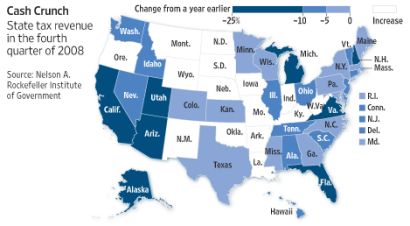

A free fall in tax revenue is driving more state lawmakers to turn to broad-based tax increases in a bid to close widening budget gaps.

At least 10 states are considering some kind of major increase in sales or income taxes: Arizona, Connecticut, Delaware, Illinois, Massachusetts, Minnesota, New Jersey, Oregon, Washington and Wisconsin. California and New York lawmakers already have agreed on multibillion-dollar tax increases that went into effect earlier this year.

Fiscal experts say more states are likely to try to raise tax revenue in coming months, especially once they tally the latest shortfalls from April 15 income-tax filings, often the biggest single source of funds for the 43 states that levy them.

And WSJ provides this useful map of who is likely to be affected:

I’m thinking it was a bad idea for 50% of the country to not pay income taxes, then to spend on social services like drunken sailors.